5 Steps to Get Back Control Over Low-Quality Deal Flow

Your goal as a VC is to efficiently and profitably invest the money from your LPs. To do this, you have to find the best deals in the market. For this you can use different deal sources, like:

- Network/ referrals

- Accelerators and incubators

- Social media channels

- Seminars and webinars

- Pitch events

- Matching platforms

- Website

- Email (founder finds you)

You will receive the best quality deal flow from network and referrals, pitching events and accelerators. The worst quality deal flow is usually received directly from startup founders via social media channels, website and e-mail. For many VCs, this makes up 80% to 90% of the total deal flow.

The quality is poor as:

- The deal flow is outside the scope of the VC

- Pitch decks and other documents are incomplete or very concise

- Text and layout are not professional and/or commercial enough

- The founder is not at all ready to raise an investment

Tough, but you do need a lot of deal flow to get to the desired number of annual investments. Let's reverse engineer this.

As an example, if you want to make 5 investments per year (on average 0.5% of all deal flow received), then you need at least 1,000 investment applications per year. About 850 to 900 come through the less good sources but must be analyzed. There will certainly be gems here, so you have to go through it. How do you do that? How do you get control of the deal flow? Here are five steps to get you started:

- Describe your investment profile: Describe the type of investment you are looking for. A page about this on your website can capture some unnecessary deal flow.

- Funnel all deal flow to a central place: Make sure that all your deal flow eventually ends up in one place where all colleagues have access. This provides an overview and structure.

- Structure the incoming deal flow: Deal flow comes in all shapes and sizes. If you can structure your deal flow, it will significantly reduce the time it takes to analyze all deal flow. For example, consider a Google Form on your website.

- Standard screening checklist: If you have a grip of your flow, it is important to analyze and assess it efficiently. Use a standard checklist. The checklist must include the most important core elements of the VC's investment profile so that it can be tested against it. This way you can also see through less attractive pitches.

- Use a CRM system: Structure the data. Instead of using an Excel document, you can place the data in a CRM. In good CRM systems it is possible to set up a standard form where you can store all the basic data. This is how you create a reference work.

- With steps 1 to 5 you will gain back control. However, this does come at a price, because it takes preparation, perseverance, punctuality and organization to get this right on track.

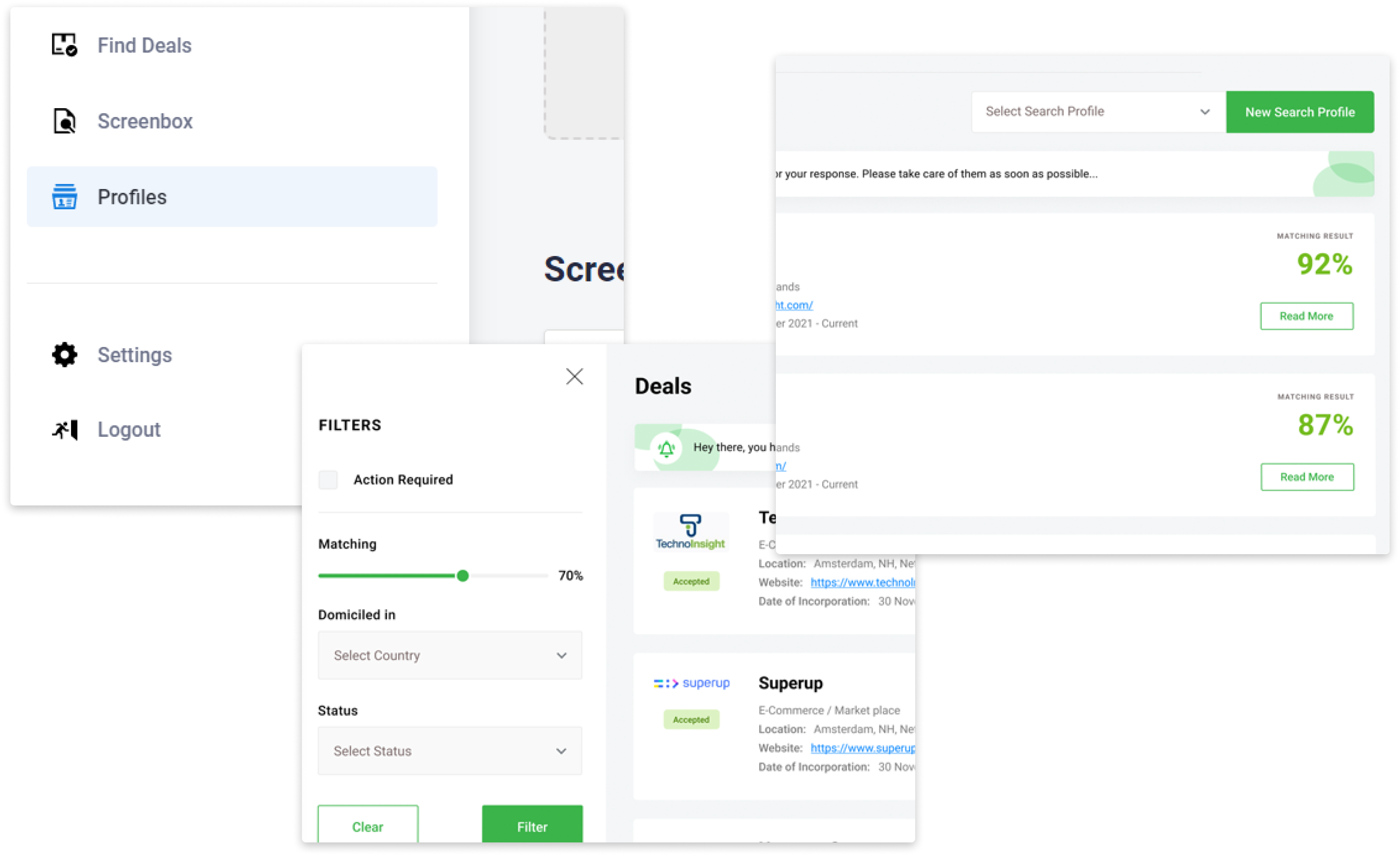

- But what if there was a solution that arranges all this for you without human intervention? A SaaS solution that can funnel deal flow from all sources, screen them against your investment profile, offer you the right projects in a standard format (and politely decline the rest) and automatically add them to the CRM. We are talking about the Siphter ScreenBox.

- Check out the ScreenBox now and request a demo at:

- With steps 1 to 5 you will gain back control. However, this does come at a price, because it takes preparation, perseverance, punctuality and organization to get this right on track.

- But what if there was a solution that arranges all this for you without human intervention? A SaaS solution that can funnel deal flow from all sources, screen them against your investment profile, offer you the right projects in a standard format (and politely decline the rest) and automatically add them to the CRM. We are talking about the Siphter ScreenBox.

- Check out the ScreenBox now and request a demo at:

The Ultimate Overview of the VC Tech Stack

The Ultimate Overview of the VC Tech Stack

Download Our Ultimate Overview Of The VC Tech Stack For Free!