How to Source Investment Opportunities with ScreenBox

When it comes to deal flow, many VC’s think that they can handle deals coming in from all different sources. However, we’re all human and with so much data to organise, our process can become messy. Unorganised VC’s find they’re missing out on huge deals if they don’t have a process in place for tracking down promising investment opportunities.

In this article on creating a smooth deal flow process, you’ll learn about some of the best processes for finding and evaluating potential investments, as well as tips for staying organized and prioritizing your options.

We’re going to be exploring deal flow in a nutshell, managing your sources of investment opportunities, screening deals and evaluating your deal flow efficiently to make better informed decisions.

What is deal flow?

Deal flow refers to the process of sourcing, screening, and selecting investment opportunities and can include finding investment ideas by talking with people in your network or by researching trends in the market that you think would yield profitable investments.

The Sources of deal flow

There are three primary sources of deal flow: the entrepreneur, business networks (both personal and professional), or referrals from other investors.

Entrepreneurs are often looking for funding when they have a product or service that is ready for launch but don't have the capital necessary for full-scale production.

Business networks can be helpful in sourcing deals if you know what you're looking for and have a well-developed network.

Finally, referrals from other investors can be a great source of deal flow if you know who to ask.

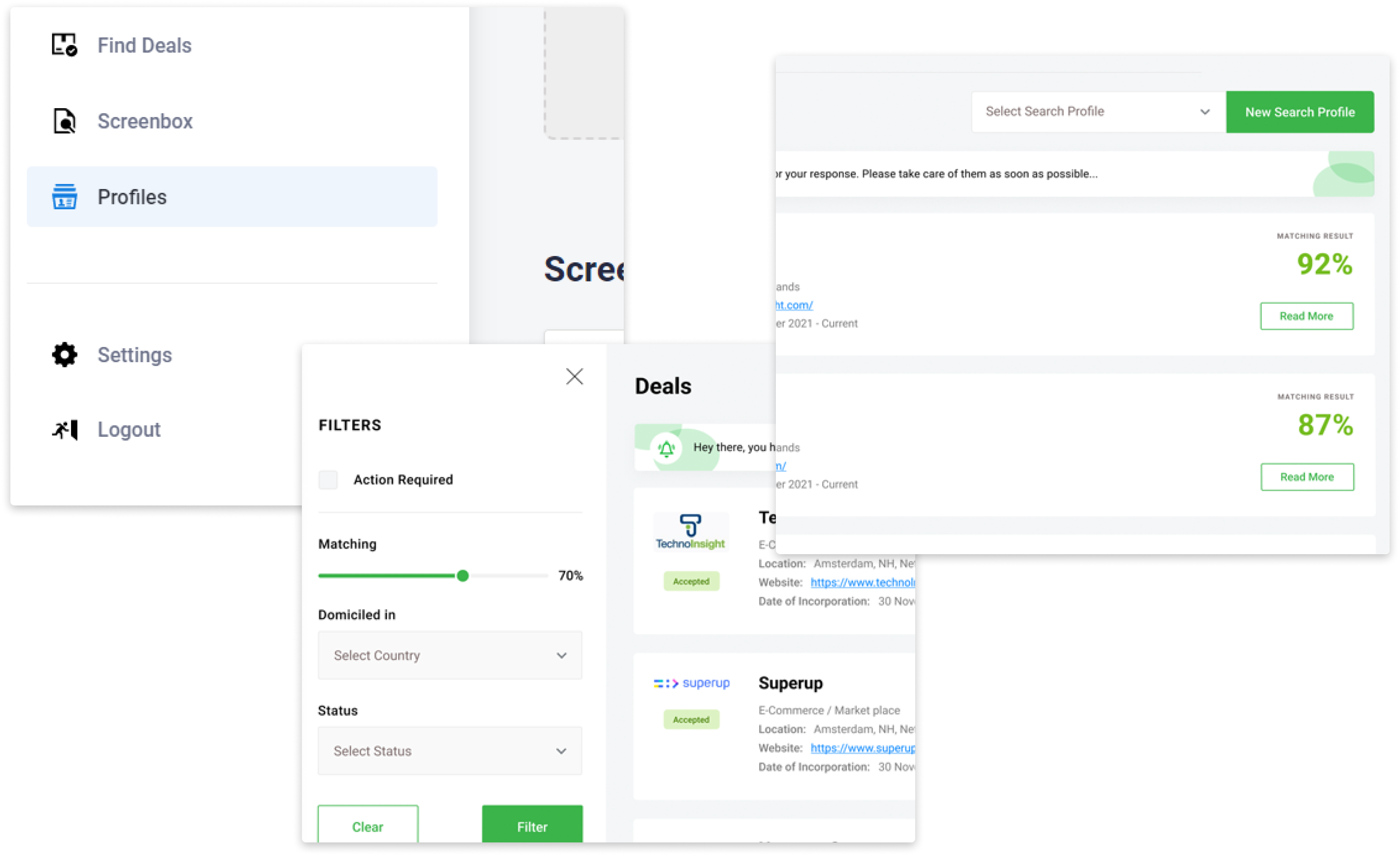

ScreenBox which creates one deal source for all of our clients. Siphter will funnel the deal flow from all your deal sources to one place. You no longer have to manage the different sources through which you receive deal flow.

Screening deal flow

It's hard enough to keep up with the volume of deals that come across your desk. So how do you decide which ones are worth pursuing? You need a system for sifting through the noise. ScreenBox is designed for entrepreneurs who want to never miss a deal again. It takes all your deal sources and funnels them into one place.

The ScreenBox will funnel, screen and manage your incoming deal flow and cut your analytics and manual tasks by 85%. Now you can focus on the deals that matter and add new deal sources.

Evaluating Investment Opportunities

When evaluating investment opportunities it's important to have a process in place. The first step is sourcing deals which we have covered above. The next step is screening deals. This can be done based on specific criteria you are looking for in an investment opportunity such as the size of the company or stage of development. Once you've narrowed down your potential investment opportunities you'll want to select one or more that seem promising.

As a VC, you know that having the right data in your CRM is essential in order to complete the process of sourcing, screening and selecting investment opportunities. There are four general categories of data points that can be stored in a CRM. These are 1) customer information data, 2) sales pipeline data, 3) deal flow data, 4) financials.

With ScreenBox, there will be no more time consuming manual input of detailed data. Your matching deal flow will automatically be transferred to your CRM or deal flow management software, using the Siphter API.

Try ScreenBox today to help save time when sourcing, screening and selecting investment opportunities. We estimate that you will save around 85% of your time analyzing your deal flow with us!

Book demoThe Ultimate Overview of the VC Tech Stack

The Ultimate Overview of the VC Tech Stack

Download Our Ultimate Overview Of The VC Tech Stack For Free!