Fundraising for VC's explained

Introduction

The world of venture capital fundraising is dynamic and ever-evolving, requiring investors to constantly adapt their strategies to stay ahead of the curve. In this blog, we will explore the key components of a successful fundraising process and provide practical advice on how to build and maintain relationships with limited partners.

IntroductioBuilding a Network of Limited Partners

Limited partners are critical to the success of a venture capital fundraising effort, and building a strong network of LPs requires a strategic and tailored approach. To begin, it's important to understand the investment criteria of each type of LP. For example, pension funds may prioritize stability and predictable returns, while endowments may focus on long-term growth and diversification. With this understanding, investors can develop a clear and consistent value proposition that resonates with the specific interests of each LP. This may involve crafting a customized pitch that highlights the unique attributes of the investment opportunity and demonstrates how it aligns with the LP's investment criteria.

To build a strong network of LPs, it's also important to stay connected and maintain open communication. This can be done through regular updates, in-person meetings, and other touchpoints that help to build trust and establish a relationship. In addition, investors should be transparent and responsive to the concerns and questions of their LPs, and should be prepared to provide regular and detailed reporting on the performance of their investments.

GP vs LP

In a venture capital fund, general partners perform several roles at the same time, such as the following:

- Manage the investments of funds

- Pursue investment opportunities

Limited partners invest capital with an expectation that general partners have the ability to identify the right kinds of investment opportunities. Limited partners expect an attractive return for their investment.

Preparing for Due Diligence

The due diligence process is a critical stage in the fundraising process, as it allows LPs to evaluate the potential investment opportunity in detail. To prepare for due diligence, investors should develop a due diligence plan that outlines the key objectives and milestones, as well as the necessary data and materials that will be required. This may include financial projections, market research, and information about the company's management team and business model.

To ensure a successful due diligence process, investors should also be prepared to answer tough questions and provide detailed explanations of their investment strategy and decision-making process. They should also be transparent about any risks associated with the investment and be prepared to discuss their risk mitigation strategies.

Crafting a Compelling Fundraising Story

A compelling fundraising story is a critical component of a successful fundraising process. It should provide a clear and concise overview of the investment opportunity and highlight the key value proposition of the investment. To craft a compelling story, investors should first understand their target audience and tailor the story to their specific interests and investment criteria. This may involve highlighting the market opportunity, the competitive landscape, and the key differentiators of the investment.

In addition, investors should be able to clearly communicate the potential return on investment and demonstrate why their investment represents a unique and attractive opportunity. They should also be able to articulate their investment thesis and demonstrate their understanding of the market and the company.

Negotiating Venture Capital Partnership Agreement

The final stage of the fundraising process is negotiating the Venture Capital Partnership Agreement, which outline the key terms and conditions of the investment. As a partner at a venture capital firm, negotiating Venture Capital Partnership Agreement with limited partners (LPs) is an essential part of the fundraising process. A Venture Capital Partnership Agreement outlines the basic terms and conditions of the investment, including the amount of capital being raised, the valuation of the firm, the equity stake being sold, and any specific rights and restrictions that will be applied to the investment.

When negotiating Venture Capital Partnership Agreement with LPs, it's important to be transparent and clear about the firm's investment strategy and goals. This can help build trust and establish a strong working relationship with potential investors. In addition, it's important to understand the LP's investment objectives, risk tolerance, and liquidity requirements. This information can help tailor the term sheet to meet the LP's specific needs and interests.

Conclusion

In conclusion, fundraising is a critical component of the venture capital industry and requires a deep understanding of the market, the limited partners, and the fundraising process. By following best practices and approaching each step with a strategic and tailored approach, senior analysts can successfully navigate the fundraising process and secure the capital needed to drive growth and success for their portfolio companies.

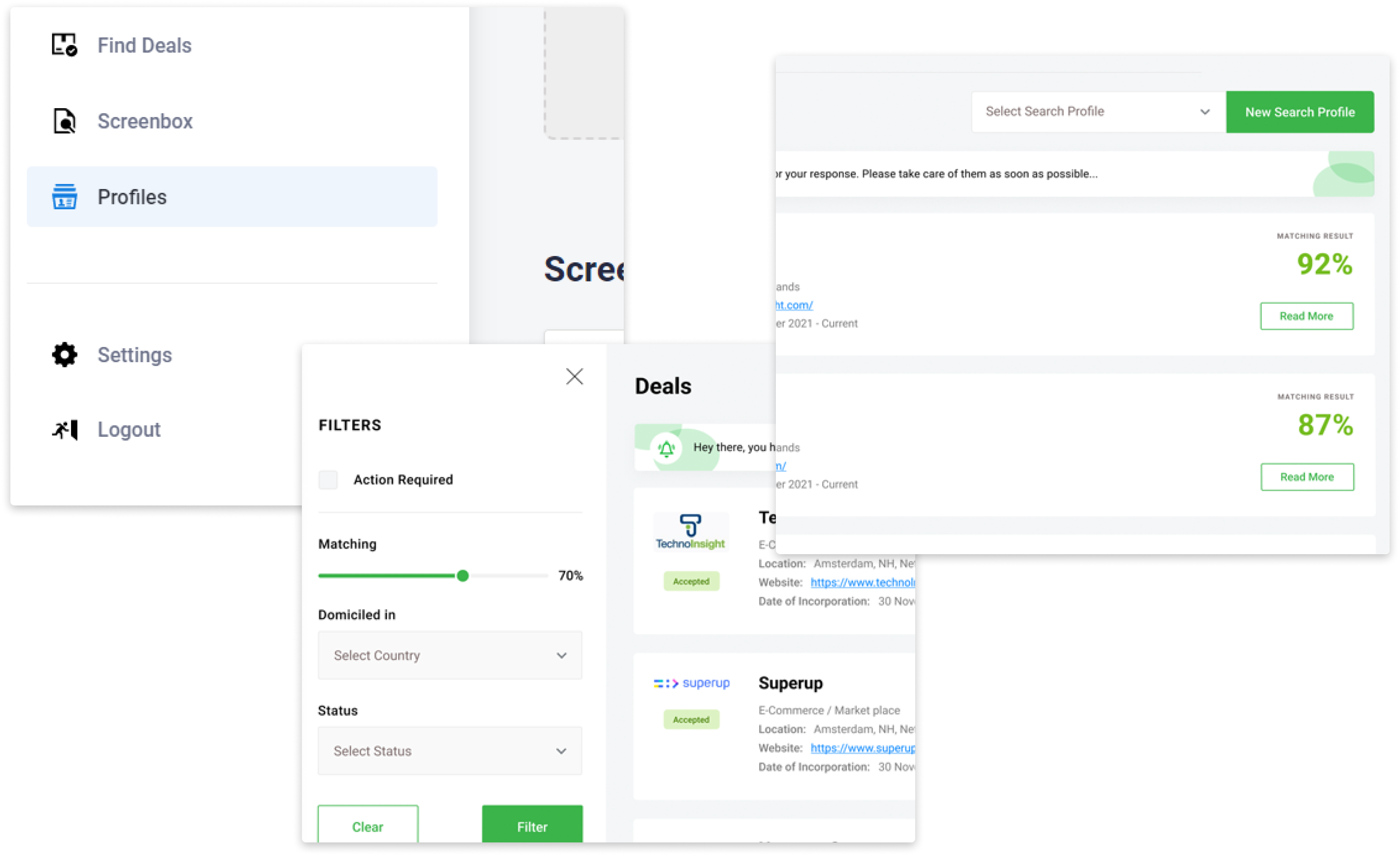

The Ultimate Overview of the VC Tech Stack

The Ultimate Overview of the VC Tech Stack

Download Our Ultimate Overview Of The VC Tech Stack For Free!