Investment Due Diligence

Introduction

Investment due diligence is a critical step in the venture capital investment process, and it plays a crucial role in determining the success of an investment. The objective of investment due diligence is to thoroughly analyse a potential investment opportunity to determine whether it is a good fit for the venture capital firm and its investors. This blog will provide an overview of the key components of investment due diligence, including market and industry analysis, financial analysis, and management evaluation.

Market and Industry Analysis

Market and industry analysis is an important step in the due diligence process. It provides a deep understanding of the market landscape and allows venture capital firms to identify key trends, growth drivers, and potential risks. Market and industry analysis can be performed using a variety of research and data sources, such as industry reports, market research databases, and competitor analysis.

When conducting market and industry analysis, it is important to consider the following key factors:

- Market size: What is the size of the market and what is the potential for growth?

- Market segmentation: Who are the target customers and what are their needs and preferences?

- Competitive landscape: Who are the main players in the market and what are their strengths and weaknesses?

- Growth drivers: What are the factors that are driving growth in the market?

- Market trends: What are the key trends and emerging technologies in the market?

Financial Analysis 101

Financial analysis is an integral part of investment due diligence, and it provides insights into a potential investment opportunity's financial health and performance. Financial analysis techniques include profitability analysis, cash flow analysis, and valuation. The objective of financial analysis is to understand the company’s financial history, identify potential risks and opportunities, and determine its future financial potential.

The following financial metrics are commonly used in venture capital analysis:

- Revenue multiples: This measures the company's revenue compared to its valuation.

- EBITDA multiples: This measures the company's earnings before interest, taxes, depreciation, and amortization compared to its valuation.

- Discounted cash flow analysis: This measures the present value of future cash flows generated by the company.

- Growth drivers: What are the factors that are driving growth in the market?

- Market trends: What are the key trends and emerging technologies in the market?

Evaluating Management Teams

The strength and effectiveness of a company's management team can be a key determinant of its success. A strong management team can help a company to grow and achieve its goals, while a weak management team can hinder its success.

When evaluating management teams, it is important to consider the following factors:

- Experience: What is the management team's experience and track record in the industry?

- Leadership: What is the management team's leadership style and ability to inspire and motivate employees?

- Vision: Does the management team have a clear and compelling vision for the company’s future?

- Strategy: What is the management team’s strategy for achieving its goals and what is its plan for executing that strategy?

To evaluate management teams, venture capital firms often conduct management interviews and assessments. These interviews should cover a range of topics, including the management team’s background, experience, leadership style, vision, and strategy.

Conclusion: Investment due diligence is an important and complex process, and it requires a deep understanding of market and industry analysis, financial analysis, and management evaluation. By gaining a deep understanding of these key components, venture capital firms can make more informed investment decisions and increase the chances of success for their investments.

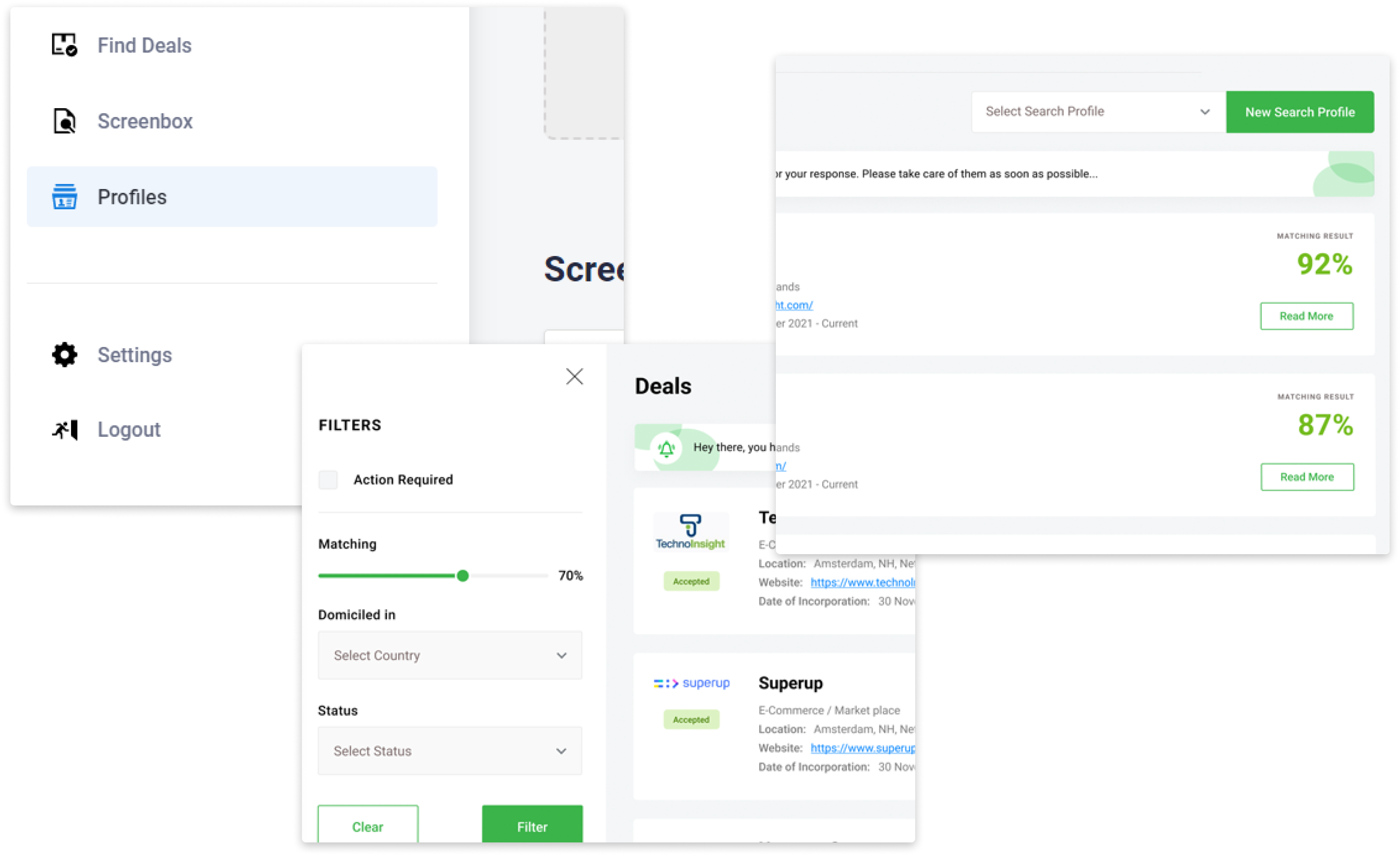

The Ultimate Overview of the VC Tech Stack

The Ultimate Overview of the VC Tech Stack

Download Our Ultimate Overview Of The VC Tech Stack For Free!