Optimizing Deal Flow

The Backbone of the Venture Capital Process

Opportunities in today's world of venture capital can come from anywhere. A few years back, a VC firm, or any other business for that matter, was limited to its geographic location. Now, with the internet and smart technology, there's an entire universe of potential at our fingertips. But it takes more than just access to these opportunities - it takes a successful system and a process to get the idea match right.

Deal flow is the lifeblood of any VC firm. In simpler words, it is the process of sourcing and screening investment opportunities. It is a multi-step process that narrows down the most promising candidates for VCs to invest in. Without a well-crafted deal flow process, it can be difficult to identify the best opportunities.

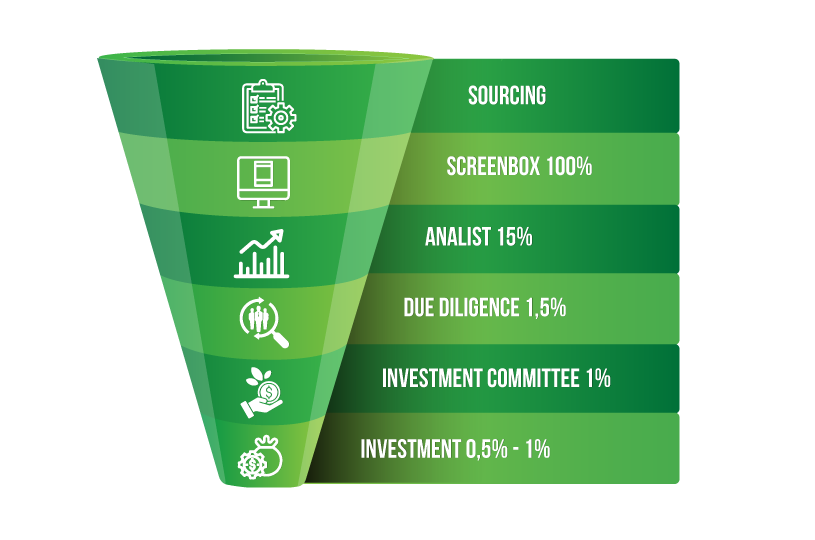

The Stages of a Deal Flow

It's not about getting the highest number of deals in - it's about getting the right number. Here are the key stages of a well-oiled deal flow process:

Deal Sourcing

The first step is to source interesting ideas and companies from multiple channels such as conferences, incubators, friends of friends, and more. Basically, the point in the cycle where a VC collects leads and assesses their potential.

An eminent investor and business analyst, Iain Bremner once said: "Good deals can come from anyone, but it’s up to the VC to find them."

Traditionally, networking has been the key here, but with the advent of technology, modern sourcing is much more efficient and effective. Nowadays, inbound marketing systems have filled a huge vacuum for VCs. Blogging, email campaigns, and social media are all great ways to acquire leads. The podcast culture has also played a big role in lead generation for many venture capital firms.

At this point, 100% of the leads should not be accepted. A pre-screening process is critical to filter out the weak ideas and companies that won't make it through the next steps.

Deal Screening

In the next step, an initial meeting is arranged to discuss the idea and company in detail. This meeting is used as an opportunity to further evaluate the potential of these companies for financial investment.

It's not just about looking at a business plan - it’s about understanding what makes this company stand out from its competitors, who are its customers, and why it has potential in the long run. A lot of venture capital firms have specific criteria on which they base their decision-making process. It could be anything from team composition to market size or even management style.

At this point, 85-90% of the leads are filtered out. The chances of further evaluation depend on the answers to these questions.

Partner Review

The next step is a partner review. It offers an opportunity to discuss the company's potential and business model with the other partners of the VC firm. After getting various perspectives on each candidate, it's up to them to decide if further evaluation needs to be done or not. This is the first internal step of due diligence. Half of the leads will move forward to the next step, the rest will be eliminated.

Due Diligence

In this stage, a comprehensive analysis is conducted to understand the company's finances, technology, plans, and team. It involves analyzing market size, competitive landscape as well as future profitability potential. Now, every deal isn't suited for venture capital, so it's important to identify those that have the potential to yield returns.

This is a crucial step because it helps eliminate the risk of investing in companies that are unlikely to succeed. It also gives an idea about how much money needs to be invested and what kind of return can be expected.

Investment Committee

The second internal step is the Investment Committee. The most promising deals are presented to a group of senior partners and officers who decide whether or not it's worth investing in.

Deployment

The final step is to invest in promising deals. After careful inspection and due diligence, the VC firm will finally choose which companies it wants to fund. Ultimately, a successful deal flow process isn't about getting the highest number of leads - it's about getting the right ones.

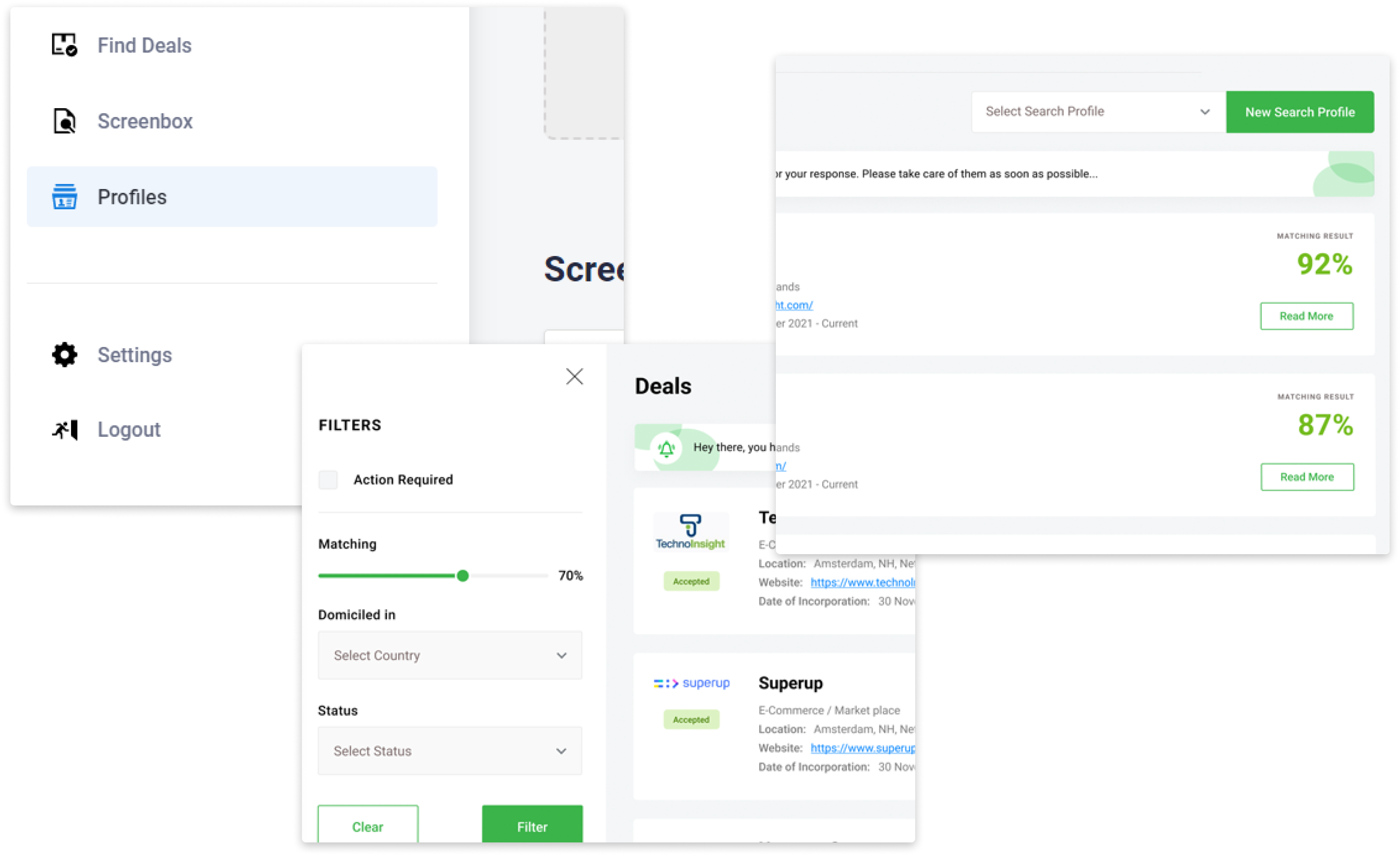

The process is a very rigorous and sometimes long one. Therefore, it can get overwhelming to sift through all the leads. That’s why VCs are turning to specialized software like ScreenBox, which offers a centralized solution for funneling deal flow from diverse sources and efficiently pre-screening them. ScreenBox captures and structures the data into a clear and practical report that highlights the top leads.

As per a pre-set filter, only the prospects that match 85% of the criterion are passed on to the dashboard. By leveraging the software’s standard evaluation process, VCs can save up to 70% of their time. Those that have not passed the criteria receive a friendly message of gratitude for their interest. This saves time and resources for both sides. Additionally, the API of ScreenBox can be integrated with other existing CRM and VC systems, making it a powerful tool for efficient and accurate deal flow management.

The venture capital process is not an easy one, but it’s necessary to identify the potential winners. Using the right software, like ScreenBox, can help streamline the process and make sure that only the best leads are considered. It’s a win-win situation - VCs get better insights into potential investments and startups have access to more resources to grow their business. Everyone involved in this process stands to benefit from using ScreenBox!

Let's make sure you get the best deal flow!

Book demoThe Ultimate Overview of the VC Tech Stack

The Ultimate Overview of the VC Tech Stack

Download Our Ultimate Overview Of The VC Tech Stack For Free!