The 6 Biggest Challenges Venture Capitalists Face

A Day in the Life of a Venture Capitalist: The Challenges They Encounter

Over the past few decades, venture capitalists (VCs) have played an increasingly important role in the world of business and finance. Although VC’s find much success in getting businesses off the ground and flourish, it doesn’t come without its pitfalls or challenges.

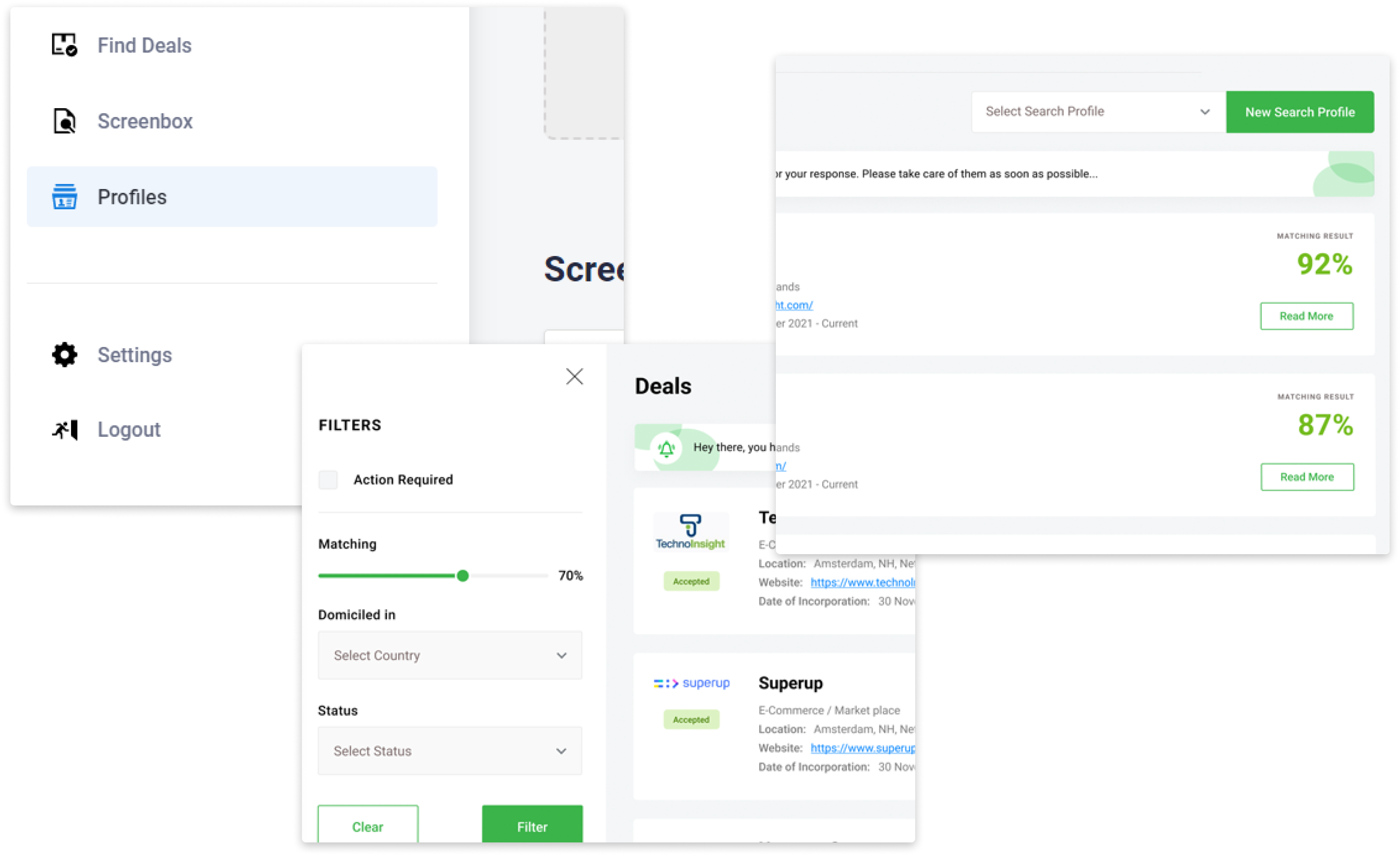

Being a venture capitalist can be tough, especially when there’s so much competition out there to find worthy new businesses to invest in. The good news is that it’s becoming easier every day, thanks to new tools like ScreenBox which lets VCs better manage their deal flow and choose which investment opportunities they feel most confident in funding.

Let’s explore some of the challenges a venture capitalist might experience in their day-to-day.

1. Access to Deals

The venture capital industry is full of a pool of highly specialised individuals, which means that at any given time there are limited high quality companies available for investment, and deals can take a long time to materialize. As a result, VCs must spend hours each day screening potential deals and sifting through the vast amounts of information available in order to find the ones with the most potential.

2. Competition Among Investors

With limited high quality companies available for investment, competition among investors can be fierce. In some cases, VCs will even compete against each other to try and convince entrepreneurs to take their money instead of someone else's.

3. Time Constraints

Faced with time constraints in the venture capital world, it is often hard to find an investor who has the right balance of expertise and availability. The best thing a VC can do is to be honest about their limitations and make sure they are upfront with entrepreneurs about what they can offer. Entrepreneurs should take the same approach, being realistic about what type of help they need.

4. Economics

Economic downturns are one of the biggest challenges venture capitalists face. A recession in a certain sector may cause investors to be cautious with their funding, which can make it difficult for a company to grow and expand. However, this is also true when there's an economic upturn. An upturn will often lead investors to invest more money into other sectors they see as profitable - meaning less money available for other sectors.

5. Limited Funds

Another challenge is that many VCs have limited funds with which they're working. This means that they have to be very particular about where their investment goes and towards which companies. This adds pressure to every deal because if it doesn’t turn out to be a success, it can be difficult to afford the next investment.

6. Regulatory Changes

One of the most common challenges is dealing with regulatory changes. When regulations change, it can have a significant impact on your business and the industry as a whole. For instance, in 2011, the SEC implemented changes to their rules and regulations for companies with more than 500 shareholders, which means that many venture capital firms are finding themselves working around the new rules. The new regulation also requires these firms to publicly disclose any transactions they make with private company shares every quarter.

Venture capitalists are always on the lookout for the next big idea, but they also have to worry about making sure that their investments will yield a return. And when it comes to evaluating startups, they have to consider not just the product or service but also the team behind it. A venture capitalist is putting a lot on the line with every investment, and they can't afford to make any mistakes.

Book demoThe Ultimate Overview of the VC Tech Stack

The Ultimate Overview of the VC Tech Stack

Download Our Ultimate Overview Of The VC Tech Stack For Free!