The Deal Flow Process

Introduction

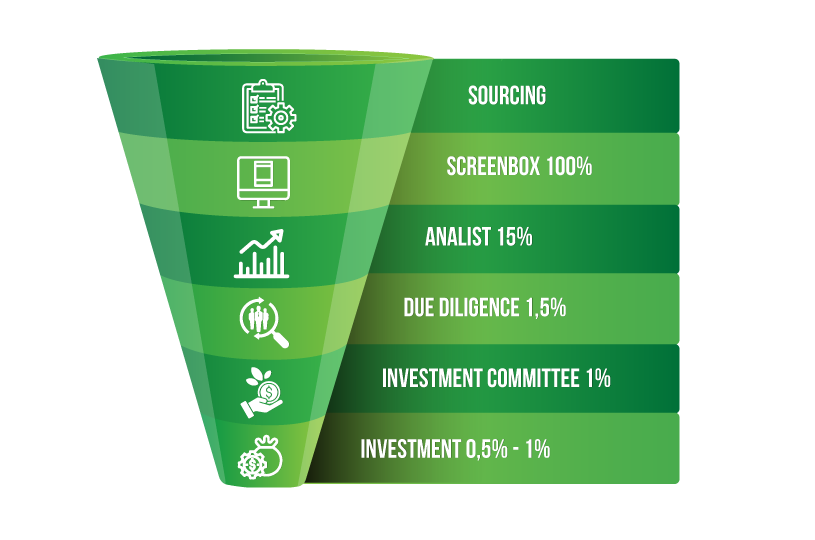

Deal flow is the lifeblood of any VC firm. In simpler words, it is the process of sourcing and screening investment opportunities. It is a multi-step process that narrows down the most promising candidates for VCs to invest in. Without a well-crafted deal flow process, it can be difficult to identify the best opportunities. It's not about getting the highest number of deals in - it's about getting the right number.

Sourcing

The first step in the deal flow process is sourcing new investment opportunities. This involves finding potential startups to invest in. Venture capital firms often have a wide network of contacts and resources that they can tap into to identify new opportunities. This can include industry events, platforms, referrals from other investors, online resources, and more.

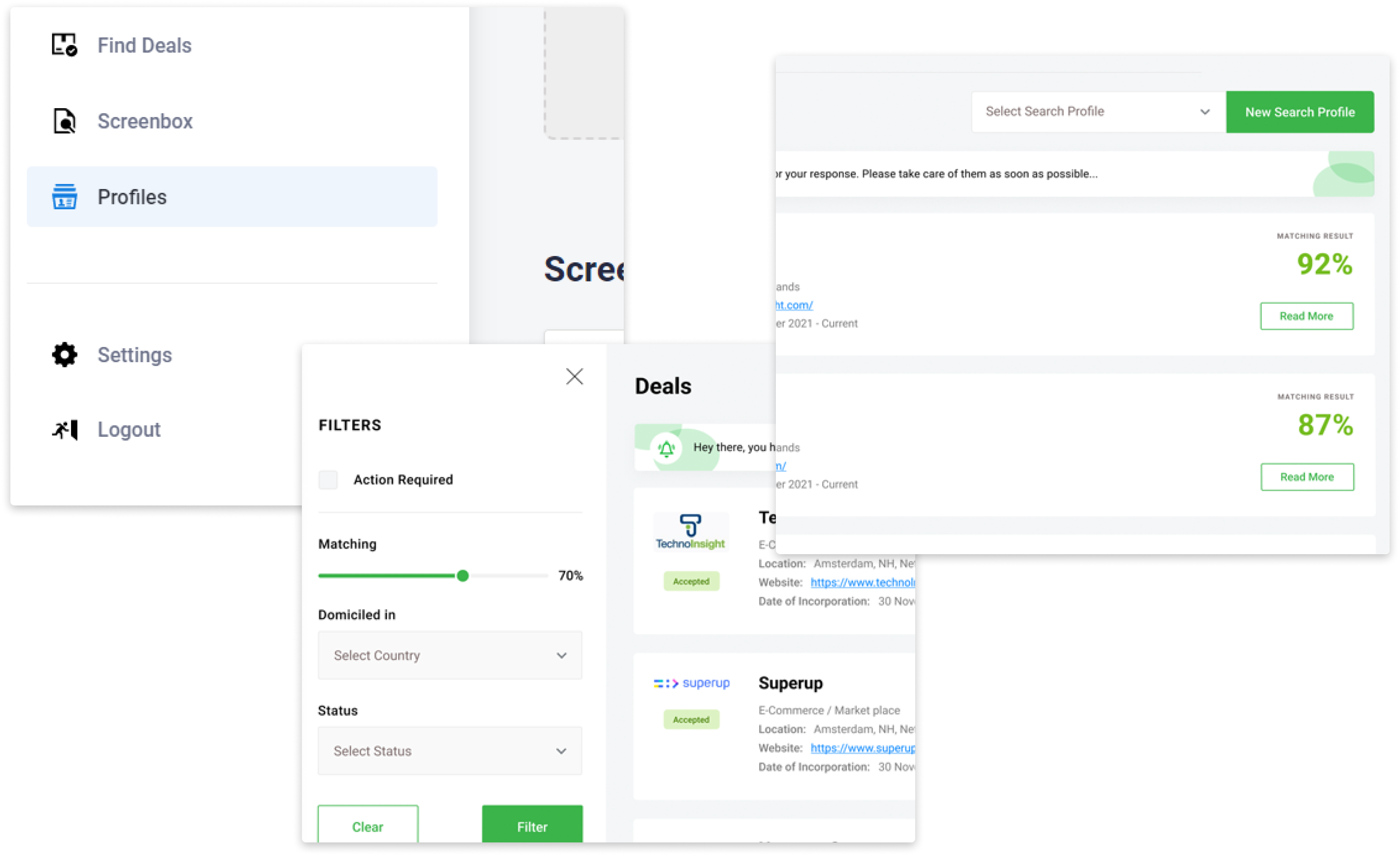

Screening

Once the venture capital firm has identified a potential investment opportunity, it moves on to the screening process. During this stage, the firm reviews the opportunity to determine if it is a good fit with the firm's investment criteria and objectives. This can include evaluating the size of the market, the stage of the company, the management team, and other factors. If the opportunity does not meet the firm's criteria, it is rejected at this stage. Only 10 to 15 % of all incoming deal flow will make it through this phase.

Due Diligence

If the opportunity passes the screening process, the venture capital firm moves on to the due diligence stage. During this stage, the firm conducts a thorough examination of the opportunity to gather all the information necessary to make an informed investment decision. This includes reviewing financials, market research, and conducting background checks on the management team. The goal of due diligence is to determine the strengths and weaknesses of the opportunity and determine if it is a good investment.

Partner Review

The next step is a partner review. It offers an opportunity to discuss the company's potential and business model with the other partners of the VC firm. After getting various perspectives on each candidate, it's up to them to decide if further evaluation needs to be done or not. This is the first internal step of due diligence. Half of the leads will move forward to the next step, the rest will be eliminated.

Investment Committee

The second internal step is the Investment Committee. The most promising deals are presented to a group of senior partners and officers who decide whether or not it's worth investing in.

Term Sheet Negotiations

If the opportunity passes due diligence, the venture capital firm moves on to term sheet negotiations. This involves negotiating the terms of the investment, including the size of the investment, the equity stake the venture capital firm will receive, and other key terms and conditions. This stage can be complex and time-consuming, but it is crucial for ensuring that both the venture capital firm and the startup are on the same page.

Investment

Once the terms are agreed upon, the venture capital firm makes the investment and becomes a shareholder in the company. This is typically done through the purchase of equity or debt securities. The investment can range from a few hundred thousand dollars to several million dollars, depending on the size of the venture capital firm and the opportunity.

Monitoring and Exit

The venture capital firm continues to monitor the company and provide support to help it grow and succeed. This can include providing mentorship, networking opportunities, and access to resources. The ultimate goal of the venture capital firm is to sell the investment for a profit, which is known as an 'exit.' This can occur through a public offering, a merger or acquisition, or other means. The exit stage is critical for generating returns for investors and is often the most complex and time-consuming part of the deal flow process.

In summary, the deal flow process is a crucial aspect of venture capital investing. It involves a series of steps that help venture capital firms to identify, evaluate, and invest in high-potential startups. The goal is to make informed investment decisions and generate high returns for investors.

The Ultimate Overview of the VC Tech Stack

The Ultimate Overview of the VC Tech Stack

Download Our Ultimate Overview Of The VC Tech Stack For Free!