The Siphter Story; from Excel to Digital Bouncer for VCs

It was early 2018 when Dennis van der Veen exited his consultancy firm and decided he wanted to invest in a tech startup. Although he had experience working with startups, he did not really know where to start.

His initial idea was to invest in an early-stage company, pre revenue - a company building a real solution with new technology like blockchain. When the whole crypto market crashed, he wanted to stay away from tokens, crypto etc. The first thing he decided to do was to state he was an investor on his LinkedIn profile. This was a rookie move that brought him a tsunami of pitch decks, one pagers and management summaries. He was not prepared for this, mentally or organizationally.

Dennis also visited events in Western Europe. This was all pre-Covid, so all the events were live events and very expensive to visit. The whole startup event business was on a high. Secondly, he searched platforms like AngelList, and several others. He still did not find deals that interested or fitted his requirements. What struck him was that all the data he left at these platforms was shared unabashedly online - crazy in this era of GDPR and privacy.

Altogether Dennis had four deal flow sources; events, LinkedIn, platforms and e-mail. Deal flow came flying in from all angles and in all shapes and sizes. Managing this became a full-time job instead of an exciting opportunity. Assessing deal flow is very labour intensive and he was afraid of missing good deals.

Dennis decided to take back control and drafted an Excel sheet with twenty criteria, with which he would rate startups and gather relevant data in a structured way. In the meantime he asked a friend to build a tool so he could enter the data quickly and have it matched against his investment criteria. The output was what we now call the startup CV. A hobby got out of hand. In the meantime startups and other investors asked for his help to find new opportunities.

To cut a long story short, Dennis found a great startup and invested in them. But he still had a database with hundreds of startups and investors seeking help. This was the first time he started thinking about building a solution to help other investors and startups achieve their goals in a structured, easily accessible and private way. But he didn’t want to be the next matching platform that failed to deliver real matching deal flow sharing data across the web.

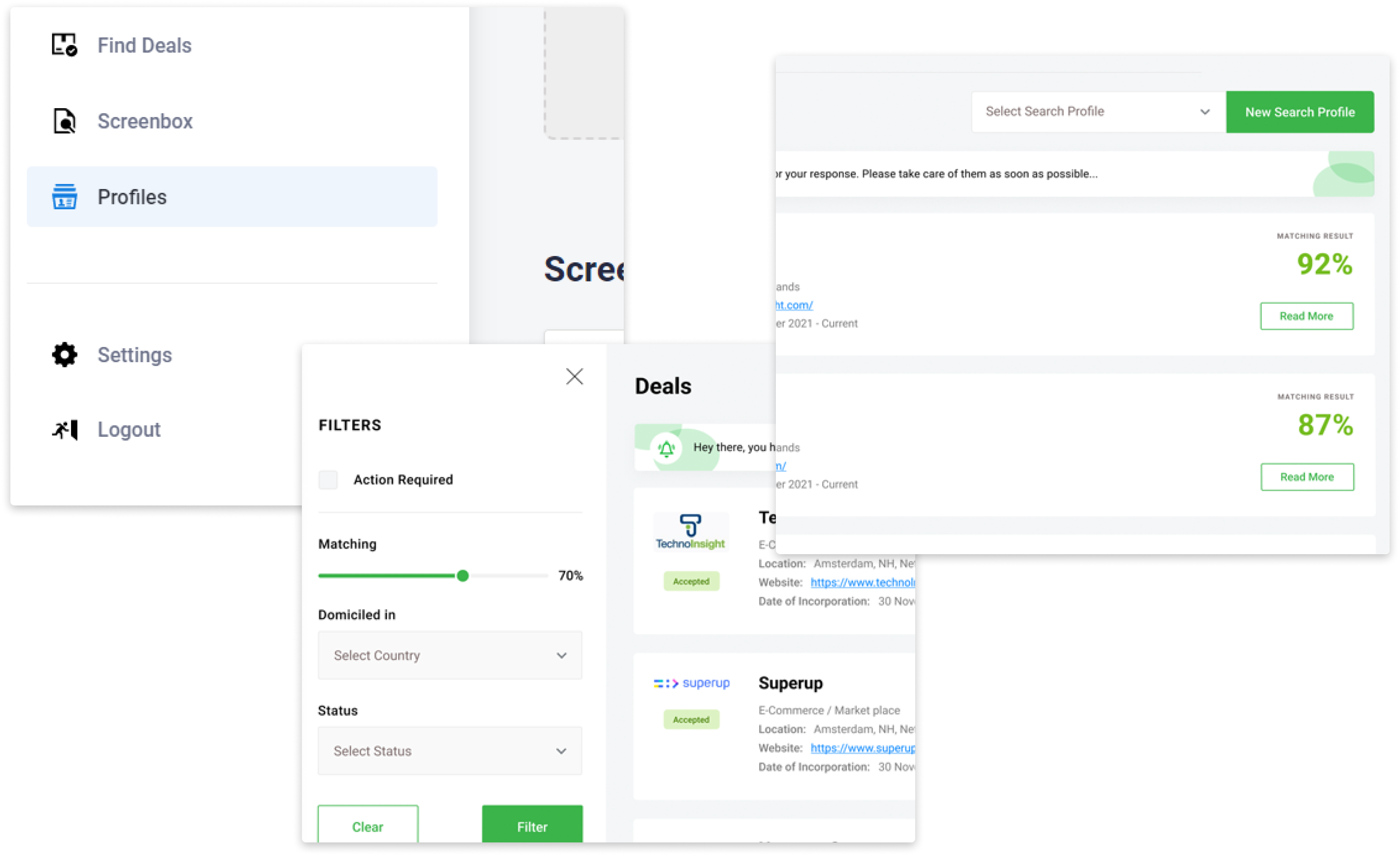

When Dennis discussed his demo version with a partner from a venture capital firm, the partner asked him to build a solution to help him funnel and screen all the incoming deal flow, like a digital doorman to his team. After finishing the matching platform Dennis and his team built the ScreenBox. With a unique link, all deal flow is funnelled, structured in a startup CV and matched against the VC’s specified investment criteria. The matching deal flow is automatically transferred to the CRM.

Dennis solved four problems with the ScreenBox:

- Managing several different deal sources at once

- High influx of low-quality incoming deal flow

- Labour intensive screening of deal flow

- Insufficient quality deal flow

Siphter offers a SaaS solution that can funnel all the deal flow from all sources, screen them against your investment profile, offer you the right projects in a standard format (and politely declining the rest) and automatically adds it to the CRM. The Siphter ScreenBox. Now we have saved you time handling low quality deal flow, we offer additional quality deal flow from our database.

Check out the ScreenBox now and request a demo. Check out the ScreenBox now and request a demo.

Request a DemoThe Ultimate Overview of the VC Tech Stack

The Ultimate Overview of the VC Tech Stack

Download Our Ultimate Overview Of The VC Tech Stack For Free!