The top 3 trends in deal flow for VC's

In the VC world, it's all about deal flow. Deal flow refers to how many companies are available for investment at any given time, and it can have a significant effect on the size of your portfolio, which in turn can affect your value as an investor. In this article, we'll look at the top three trends in deal flow for VC's, so you know where is best look for your next investment.

A surge in health and wellness startups

The venture capital industry is no stranger to the impact of trends and emerging technologies, and health and wellness startups have been no exception. In the past few years, there has been a surge in the number of health and wellness startups receiving funding from venture capitalists.

The trend of increased investment into health and wellness startups is driven by several factors. One is the rise of consumer demand for health and wellness products and services, as well as an increased focus on self-care in today's society. Additionally, technological advancements in healthcare technology have made it easier for entrepreneurs to develop innovative solutions in this space.

Startups in the health and wellness space are focusing on a wide variety of areas, including physical and mental health, nutrition, diet, sleep, exercise, and overall wellness. Some of these startups are developing products that can help track and monitor health metrics, while others are providing online resources or educational programs. The increase in venture capital funding for health and wellness startups reflects investor confidence in the potential for these companies to make an impact in the lives of consumers.

It's clear that the trend of increased investment in health and wellness startups shows no signs of slowing down. As investors continue to recognize the potential of this sector, it's likely that we will see more innovative solutions being developed and funded in the near future.

A rise in female-founded startups

Female founders are receiving more attention and investment than ever before. According to Crunchbase, over $2.8 billion dollars was invested into female-founded startups in 2020, an impressive jump from the $1.5 billion invested in 2019. This year looks to be even better.

Why are VCs beginning to put so much faith into these businesses? One reason is the rise of customer-centric business models. Female-founded startups are often founded on the idea of providing a solution to a customer need, rather than simply trying to monetize a product or service. As a result, these companies tend to have a better customer retention rate and higher revenue growth than male-founded startups.

Another reason is the overall increase in diversity and inclusion initiatives within the venture capital world. Women are gaining access to resources and funding that they would not have had access to in years past. This has allowed them to make their ideas a reality and present them to potential investors, giving them a greater chance of success.

As the venture capital world continues to open up to female-founded startups, we can expect to see an increase in deal flow for VCs in the near future. Investing in these businesses will give investors the chance to capitalize on some of the greatest minds in business and drive greater returns for their portfolio.

Increasing number of startups in Cybersecurity

In the past few years, there has been a significant increase in the number of startups looking to break into the cybersecurity industry. The surge in cyberattacks has created an urgent need for more advanced security solutions, driving venture capital firms to invest heavily in this sector.

Investment in cybersecurity startups has skyrocketed over the last year, with total funding hitting a record high of $7.3 billion in 2019. This is almost three times higher than it was five years ago and is on an upwards trend.

Cybersecurity startups are attractive investments for venture capitalists, as they often have strong intellectual property rights, their products and services can be quickly integrated into existing systems, and they offer lucrative returns. VCs are also drawn to the promise of investing in companies that are providing much needed solutions in a rapidly growing market.

VCs have identified several trends within the cybersecurity startup space which have made them particularly interested in investing in these companies. These include:

It's important for venture capitalists to stay on top of the latest trends in deal flow in order to remain competitive. We have highlighted the top 3 trends in deal flow that VCs should be aware of. In order to make the most out of their investments, venture capitalists must remain up-to-date on these trends and use them to guide their decision-making. By doing so, VCs can maximize their returns and position themselves for long-term success.

Increasing number of startups in Cybersecurity

It's important for venture capitalists to stay on top of the latest trends in deal flow in order to remain competitive. We have highlighted the top 3 trends in deal flow that VCs should be aware of. In order to make the most out of their investments, venture capitalists must remain up-to-date on these trends and use them to guide their decision-making. By doing so, VCs can maximize their returns and position themselves for long-term success.

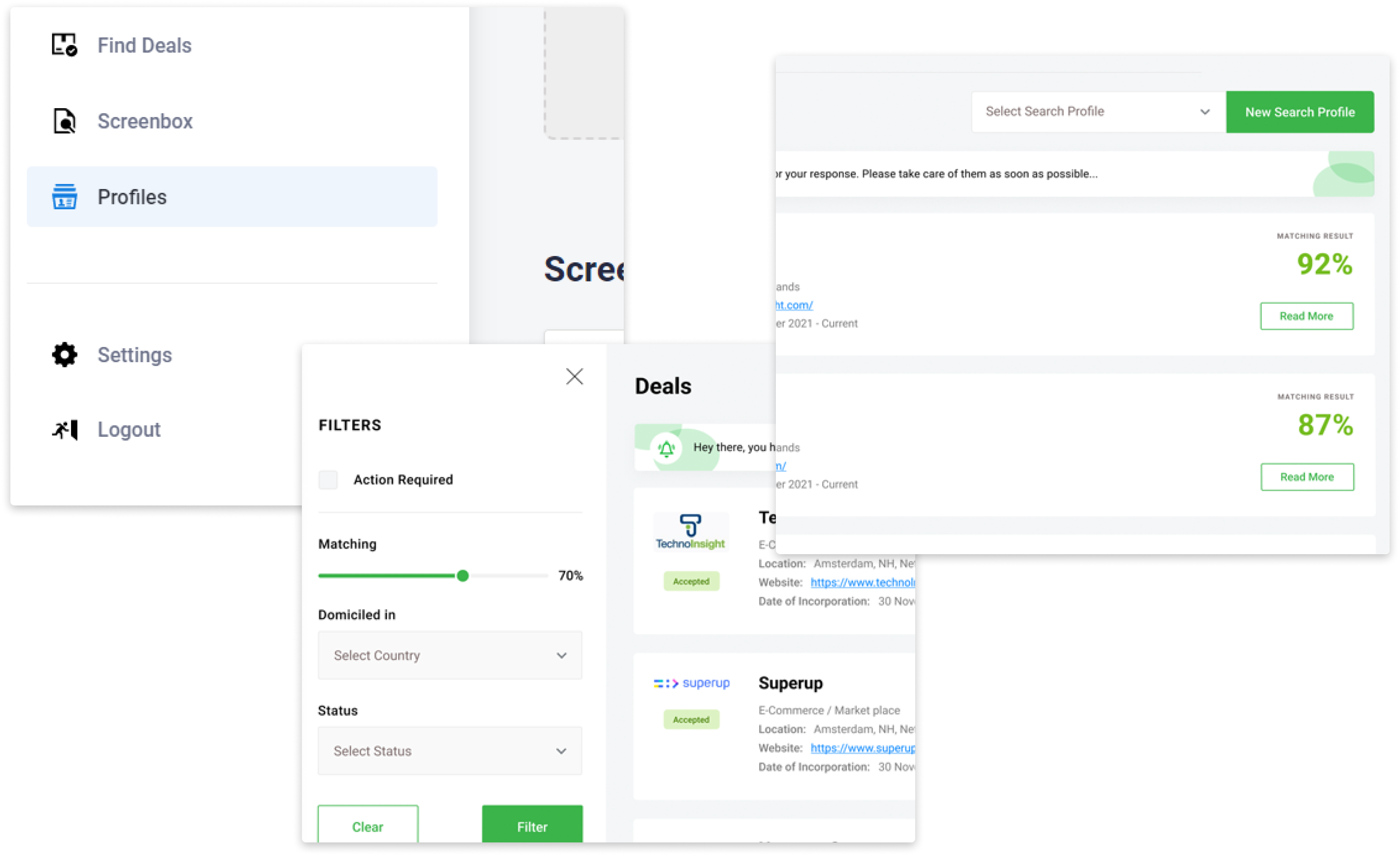

Book demoThe Ultimate Overview of the VC Tech Stack

The Ultimate Overview of the VC Tech Stack

Download Our Ultimate Overview Of The VC Tech Stack For Free!