The VC Dictionary: 101 Essential Definitions Unlocked

Welcome to our comprehensive dictionary, designed specifically for people working in the startup ecosystem. With 101 succinct and informative definitions, this dictionary is an essential tool for anyone seeking to navigate the fast-paced and dynamic world of startups and venture capital.

Accelerator

A program designed to help early-stage startups rapidly grow and develop, typically providing mentorship, resources, and access to funding.

Angel Investor

An individual investor who provides capital to early-stage startups, often in exchange for equity and with a higher risk tolerance than institutional investors.

Annual Recurring Revenue (ARR)

Measures the total recurring revenue per year that a company expects to receive from its customers for providing them with products or services.

Annual Run Rate (ARR)

A measure of the annual revenue that a SaaS company would generate if its current monthly revenue remained constant.

Average Revenue Per User (ARPU)

A measure of the average revenue generated by a SaaS company per user on a monthly or annual basis.

Bootstrapping

The practice of starting and growing a company with limited external funding, relying on self-funding, cost-cutting measures, and other creative strategies.

Bridge Loan

A short-term loan used to bridge the gap between a company's current financing and a future funding round.

Burn Rate

The rate at which a company is spending its cash reserves, typically used to measure the speed at which it is burning through its runway.

Customer Acquisition Cost (CAC)

Measures the cost of acquiring a new customer.

Cap Table

A record of a company's equity ownership and structure, including the names of all shareholders and the amount of equity each holds.

Churn rate

Measures the percentage of customers who stop doing business with an entity.

Conversion Right

The right of a holder of convertible securities, such as convertible bonds or convertible preferred stock, to convert the security into equity at a predetermined conversion price.

Convertible Debt

Debt that can be converted into equity at a later date, often with certain conditions or triggers, such as reaching certain milestones or securing additional investment.

Convertible Note

A type of investment instrument that can be converted into equity at a later date, typically at a discount to the company's next financing round.

Crowdfunding

The practice of raising small amounts of capital from a large number of individuals, typically through online platforms, to finance a product or business idea.

Customer Acquisition Cost (CAC)

The cost of acquiring a new customer, including marketing, sales, and other related expenses.

Customer Lifetime Value (CLTV)

Measures the total value a customer brings to a company during their relationship.

Customer Satisfaction (CSAT)

A measure of customer satisfaction with a SaaS company's product or service, often obtained through surveys or Net Promoter Score (NPS) measurements.

Down Round

A financing round in which a company raises capital at a lower valuation than its previous round, indicating a decrease in investor confidence or market conditions.

Due Diligence Report

A comprehensive report prepared by a venture capital firm or investment bank as part of the due diligence process, outlining the results of the research and analysis of a potential investment opportunity.

Early Stage

The stage of a company's development that typically occurs after the seed stage but before significant growth and revenue generation.

Entrepreneur

An individual who starts and manages a new business venture, often taking on significant risk and responsibility to bring a new product or service to market.

Equity

Ownership in a company, represented by shares of stock.

20 Equity Crowdfunding

A form of crowdfunding in which investors receive equity ownership in a company in exchange for their investment.

Equity Dilution

The decrease in an individual shareholder's ownership percentage of a company as a result of new shares being issued.

Exit

The process of selling a company or taking it public, resulting in a return on investment for shareholders.

Exit Strategy

The plan for realizing a return on investment, such as through an IPO, acquisition, or secondary market sale of shares.

Financial Projections

Predicted financial performance of a company, including revenue, expenses, and profitability, typically presented in the form of a budget or business plan.

First Mover Advantage

The advantage gained by being the first company to enter a market and establish a presence, potentially establishing brand recognition, customer loyalty, and barriers to entry for competitors.

Follow-On Investment

An additional investment made by a venture capital firm in a portfolio company that it has already invested in.

Founders' Stock

The equity ownership of a company's founders, typically reserved for their personal use or as a form of compensation.

Free Trial Conversion Rate

A measure of the percentage of users who sign up for a paid subscription after using a SaaS company's product or service during a free trial period.

Fund

A pool of capital raised by a venture capital firm to invest in startups.

Fund of Funds

An investment fund that invests in other investment funds, providing diversification and exposure to a wider range of investment opportunities.

General Partner (GP)

The managing partner in a limited partnership, responsible for making investment decisions and managing the fund.

Gross Margin

The difference between a company's revenue and its cost of goods sold, expressed as a percentage of revenue.

Gross Bookings

A measure of the total value of all contracts signed by a SaaS company, including both new and renewing contracts, and providing a more comprehensive view of the company's revenue growth potential.

Gross Churn Rate

A measure of the percentage of customers who cancel their subscriptions or do not renew on a monthly or annual basis.

Gross Dollar Churn

A measure of the total dollar value of subscribers who cancel their contracts with a SaaS company or do not renew, over a specific period of time.

Gross Dollar Retention (GDR)

A measure of the total dollar value of subscribers who remain with a SaaS company over a specific period of time, compared to the previous period.

Growth Equity

Investment made in a company with a proven track record, focused on helping it scale and reach its full potential.

Growth Hacking

The use of creative, unconventional, and data-driven methods to achieve rapid and sustainable growth for a company.

Holding Company

The use of creative, unconventional, and data-driven methods to achieve rapid and sustainable growth for a company.

Incubator

A program or organization that provides support and resources to help early-stage startups grow and develop, often including mentorship, access to funding, and shared office space.

Intellectual Property (IP)

The legal rights associated with a company's unique creations, inventions, and ideas, including patents, trademarks, and copyrights.

Key Performance Indicator (KPI)

A metric used to measure the performance and progress of a company, such as monthly revenue or active users.

Lead Investor

The venture capital firm or individual who takes the lead role in a financing round, often providing the majority of the capital and setting the terms for the round.

Lean Startup

A method of startup management that emphasizes rapid iteration and customer feedback, designed to minimize waste and increase the chances of success.

Leveraged Buyout (LBO)

The acquisition of a company using debt as the primary source of financing, with the expectation that the company's future earnings will be used to repay the debt.

Lifetime Value (LTV)

A measure of the total value that a customer is expected to bring to a SaaS company over the entire course of their relationship.

Limited Partner (LP)

An individual or institution that invests in a limited partnership, providing capital in exchange for a share of the profits and limited liability.

Liquidity

The ability to convert an asset into cash easily and quickly, usually achieved through a sale or public offering.

Liquidity Event

An event that enables an investor to realize a return on their investment, such as an IPO, acquisition, or secondary market sale of shares.

Market Penetration

The extent to which a company has captured a specific market or customer segment, usually expressed as a percentage of total market size.

Monthly Active Subscribers (MAS)

A measure of the number of active subscribers to a SaaS company's product or service on a monthly basis.

Monthly Active Users (MAUs)

A measure of the number of unique users who interact with a SaaS company's product or service on a monthly basis.

Market Sizing

The process of determining the potential size and value of a market for a specific product or service.

Monthly Recurring Revenue (MRR)

A measure of the recurring revenue generated by a SaaS company from its subscribers on a monthly basis, excluding one-time or non-recurring payments.

Mezzanine Financing

Debt financing that falls between traditional debt and equity financing, typically featuring higher interest rates and the option to convert to equity in the future.

Mezzanine Round

A later-stage round of financing for a company that is preparing for an IPO or a strategic acquisition.

Milestone

A key event or accomplishment in a company's development, such as the launch of a new product, reaching a certain level of revenue, or securing a major customer.

Minority Investment

An investment in a company in which the investor holds less than 50% of the equity, leaving control of the company in the hands of its founders and existing management team.

Net Churn Rate

An investment in a company in which the investor holds less than 50% of the equity, leaving control of the company in the hands of its founders and existing management team.

Net Churn Rate

A measure of the Gross Churn Rate, adjusted for new customer additions in the same period.

Net Dollar Retention

A measure of the Gross Dollar Retention, adjusted for new customer additions and price increases over a specific period of time. This metric provides a more accurate picture of a SaaS company's overall revenue growth.

Net Promoter Score (NPS)

A measure of customer loyalty and satisfaction, calculated by asking customers how likely they are to recommend a company or product to others.

Non-Disclosure Agreement (NDA)

A legal agreement between two parties in which one party agrees not to disclose confidential information to third parties.

Operating Expense

The expenses incurred by a company in the course of its normal business operations, excluding capital expenditures.

Option Pool

A set aside portion of a company's equity reserved for future issuance to employees, advisors, and others.

Product Market Fit

The point at which a company's product or service meets the needs and preferences of its target market, resulting in strong customer adoption and growth.

Post-money Valuation

The valuation of a company immediately after a financing round, used to calculate the equity ownership of new investors.

Pre-Money Valuation

The valuation of a company immediately prior to a financing round, used to calculate the equity ownership of new investors.

Pilot Program

A small-scale test of a product or service, designed to demonstrate its viability and gather customer feedback.

Pitch Deck

A presentation used to pitch a business idea or investment opportunity to potential investors or customers.

Post-Money Valuation

The valuation of a company after an investment round, taking into account the new capital received.

Pre-Money Valuation

The valuation of a company before an investment round, used as a basis for negotiating the terms of the investment.

Renewal Rate

A measure of the percentage of subscribers who renew their contracts with a SaaS company on a monthly or annual basis.

Return on Investment (ROI)

The return realized on an investment, typically expressed as a percentage of the initial investment.

Return Multiple

The multiple of the initial investment used to calculate the return on investment, typically expressed as a ratio.

Royalty

A payment made to the owner of a patented technology, trademark, or other intellectual property for the use of that property.

Runway

The amount of time a company has to achieve profitability or raise additional funding, usually expressed as the number of months the current cash balance will last.

Sales Conversion Rate

A measure of the percentage of sales leads that are converted into paying customers.

Scale

The process of growing a company's operations, customer base, and revenue, often requiring significant investment and infrastructure development.

Scaling

The process of expanding a company's operations, product offerings, and customer base, typically in order to achieve growth and profitability.

Secondary Market

A market for the sale of previously issued securities, such as stocks or bonds, typically by existing investors rather than the issuer.

Seed Capital

Early-stage investment made in a startup to help it validate its business idea and build its initial product or service.

Seed Round

The initial round of financing for a startup, typically used to prove the viability of the business concept and develop a minimum viable product (MVP).

Series A Round

The first round of institutional investment in a startup, typically following a successful seed round and aimed at scaling the business and preparing for a Series B round.

Series B Round

A follow-on investment round for startups that have demonstrated traction and are seeking to scale their operations and expand into new markets.

Stock Option

A type of compensation in which employees are granted the right to purchase shares of the company's stock at a discounted price.

Sweat Equity

The value a founder or early employee contributes to a company through their work, effort, and expertise, often in exchange for a stake in the company.

SWOT Analysis

A strategic planning tool used to evaluate the strengths, weaknesses, opportunities, and threats of a company or investment opportunity.

Syndicate

A group of investors who pool their resources to co-invest in a single opportunity, providing a larger pool of capital and a greater network of resources.

Term Sheet

A non-binding document outlining the terms and conditions of a proposed investment, including the amount of capital to be raised, ownership stake, and other key details.

Unicorn

A privately held startup company valued at over $ billion, considered to be a rare and highly successful achievement.

Unit Economics

The financial analysis of a single unit of a company's product or service, used to determine the overall viability of the business.

User Engagement

A measure of how actively and frequently users are interacting with a SaaS company's product or service, including metrics such as average session length, frequency of use, and time spent in-app.

User Retention

A measure of the percentage of users who continue to use a SaaS company's product or service over time, often calculated as a cohort analysis over a specific period of time.

Valuation

The process of determining the worth or value of a company, typically used as a basis for investment decisions and negotiations.

Venture Capital Fund

A specialized type of investment fund that provides financing to early-stage and growth-stage companies in exchange for equity.

Venture Capitalist

An individual or firm that invests in startups and early-stage companies, typically taking an active role in supporting the company's growth and development.

Viral coefficient

Measures how many new users a current user brings to the product.

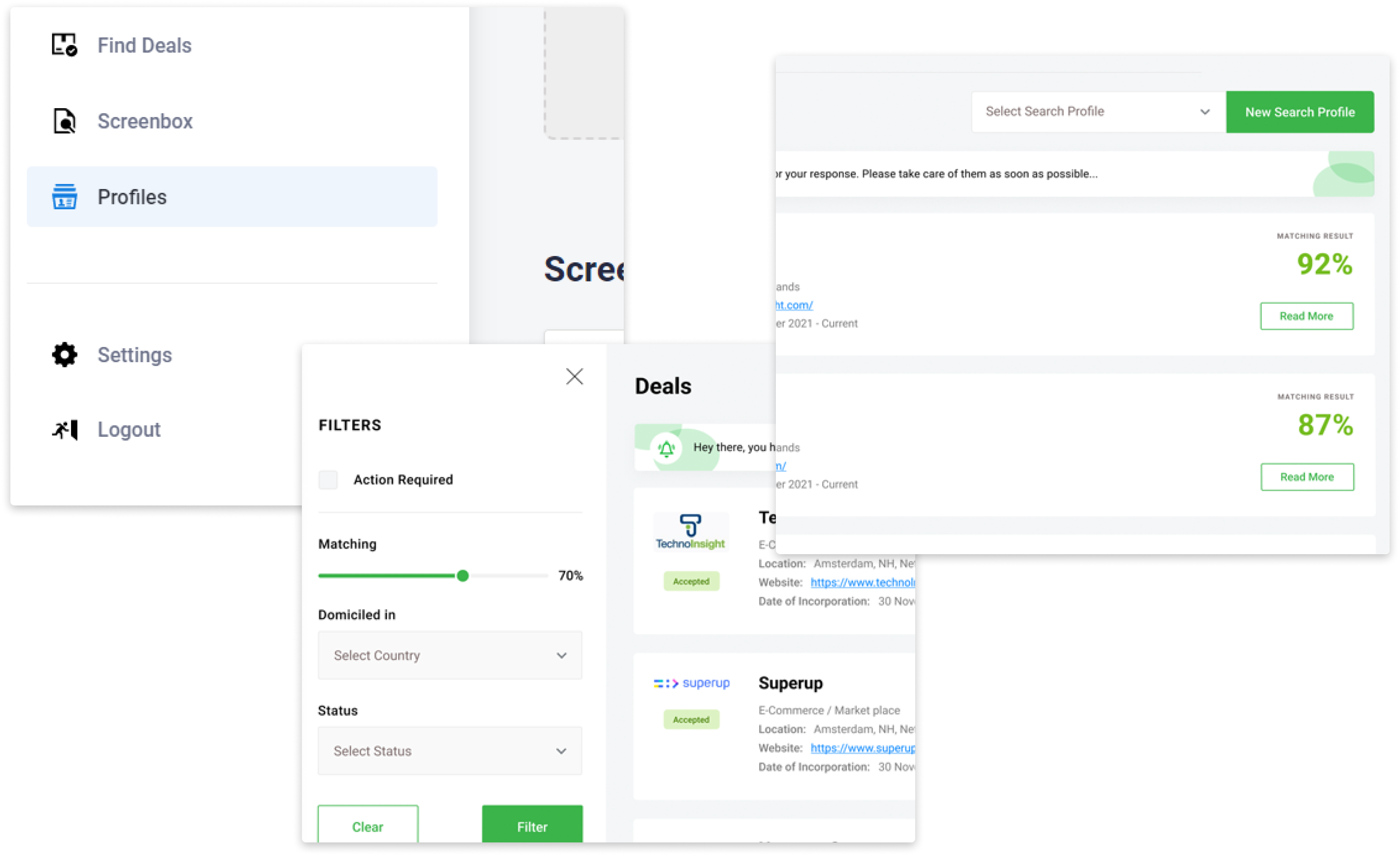

The Ultimate Overview of the VC Tech Stack

The Ultimate Overview of the VC Tech Stack

Download Our Ultimate Overview Of The VC Tech Stack For Free!