VC Deal Sourcing 101

Introduction

Deal sourcing is an integral part of the venture capital industry and requires a combination of expertise and strategy. In this blog, we will explore the different channels and tactics for sourcing deals, building strong relationships with founders, developing a deal flow pipeline, and understanding different deal types.

Understanding Different Deal Types

There are several different types of investment opportunities in the venture capital industry, including seed rounds, growth rounds, and M&A transactions. Understanding the different deal types is critical for making informed investment decisions and maximizing returns.

Seed rounds are typically used to provide early-stage startups with the capital they need to get off the ground, while growth rounds are used to finance the growth and expansion of established companies. M&A transactions are used to acquire or merge with other companies, and can provide a significant source of returns for venture capital firms.

Understanding the Different Deal Sources and Channels

Deal sources and channels come in a variety of forms, and it is important to understand the different types and what each one can offer. The most common deal sources include online platforms, such as angel investing networks, online deal rooms, and crowdfunding sites. Other sources include incubators, accelerators, and incubator programs, as well as personal and professional networks, such as friends, family, and colleagues. Additionally, dealmakers and venture capitalists often have a vast network of entrepreneurs, other VCs, and corporate ventures, who can also serve as a source of deals.

Approaches to Deal Sourcing

In the venture capital industry, deal sourcing can be a critical factor in the success of an investment. There are several approaches to sourcing deals, including proactive sourcing, passive sourcing, and strategic sourcing.

Proactive sourcing involves actively seeking out new investment opportunities by networking, attending industry events, and reaching out to potential founders and startups. This approach allows venture capitalists to build strong relationships with founders, identify potential investments early on, and become involved in the growth of a company from the beginning.

Passive sourcing involves waiting for investment opportunities to come to you, typically through referrals from other investors or founders. This approach can be less time-consuming, but it also means missing out on potentially great investment opportunities.

Strategic sourcing involves identifying specific areas of interest or industries, and then proactively seeking out investment opportunities within those areas. This approach can be more focused, but it also requires a deeper understanding of the specific market or industry.

Regardless of the approach, it is important to continually evaluate the deal flow and ensure that it aligns with the investment goals and priorities of the firm.

Building Relationships with Deal Sources and Dealmakers

Building relationships with deal sources and dealmakers is an important part of deal sourcing. Building strong relationships can lead to a more robust deal flow and a better understanding of the opportunities that are out there. One effective way to build relationships is to attend events and conferences related to the venture capital industry, such as those hosted by industry organizations, like NVCA or StartupGrind, and participate in local entrepreneurial communities. Networking with industry leaders, founders, and other VCs can also help the analyst gain insights into the industry and potential deal sources. Additionally, forming partnerships with other VC firms and corporate venture funds can help the analyst access a wider range of deal sources and increase the potential of finding high-quality deals.

Maintaining a Competitive Advantage in Deal Sourcing

Having a competitive advantage in deal sourcing can be a significant factor in the success of a venture capital firm. A strong deal pipeline not only provides access to the best investment opportunities, but it can also provide a unique perspective on the industry and the market.

To maintain a competitive advantage in deal sourcing, it is important to stay ahead of the competition by continuously building relationships with founders, dealmakers, and industry leaders. This can be done through a combination of attending industry events, participating in network opportunities, and leveraging technology to streamline the deal sourcing process.

It is also important to continually evaluate and adjust the deal sourcing strategy in response to changes in the market and industry. This includes staying up to date on industry trends, monitoring changes in the investment landscape, and adjusting the deal flow pipeline accordingly.

Having a competitive advantage in deal sourcing requires a long-term commitment and a dedication to staying ahead of the curve. By investing in building strong relationships and staying up to date on industry trends, a venture capital firm can maintain a strong and consistent deal pipeline for years to come.

Conclusion

Deal sourcing is a critical component of the venture capital industry and requires a combination of expertise and strategy. In this blog, we have explored the different channels and tactics for sourcing deals, building strong relationships with founders, developing a deal flow pipeline, and understanding different deal types.

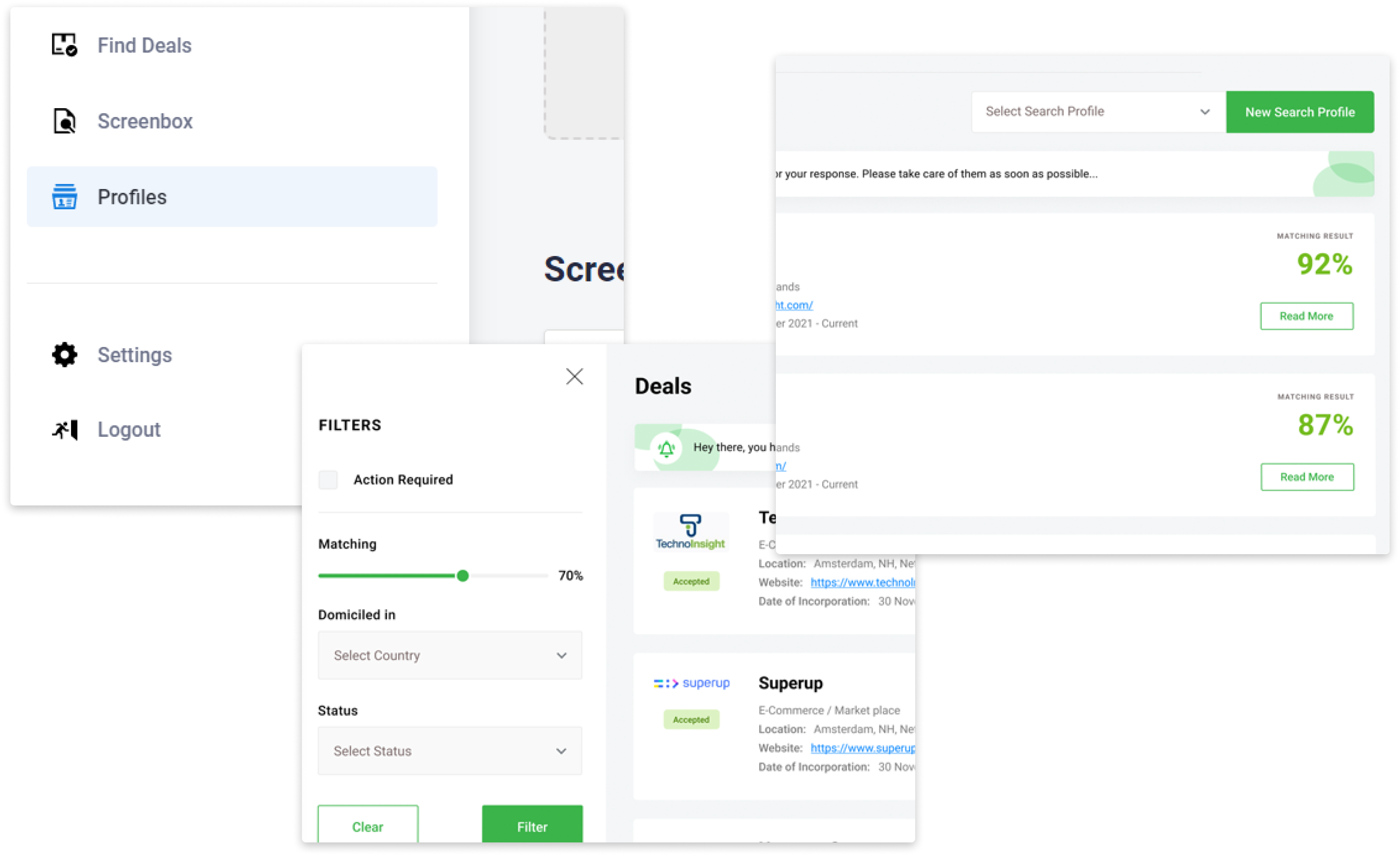

The Ultimate Overview of the VC Tech Stack

The Ultimate Overview of the VC Tech Stack

Download Our Ultimate Overview Of The VC Tech Stack For Free!