VC Portfolio Management In a Nutshell

Introduction

Portfolio management is a critical element of success in venture capital. It involves managing a group of investments (i.e., a portfolio) with the goal of maximizing returns while minimizing risk. The main objective of portfolio management is to construct a well-diversified portfolio of companies that have the potential to generate attractive returns while being exposed to acceptable levels of risk.

Venture capital firms engage in portfolio management by selecting a group of companies to invest in, monitoring their performance, and making necessary adjustments as required. The portfolio management process is designed to help venture capital firms identify and assess risks associated with their investments and develop appropriate risk mitigation strategies.

Best Practices for Risk Management

Risk management is a critical component of successful portfolio management in venture capital. Best practices for risk management include several techniques, such as risk assessment and evaluation, diversification, and risk mitigation strategies.

Risk assessment and evaluation techniques are used to identify potential risks in a venture capital portfolio. These techniques include analyzing market trends, evaluating industry trends, and assessing the financial health of portfolio companies.

Diversification is another important risk management technique. By investing in a variety of companies across different industries and stages, venture capital firms can reduce their overall portfolio risk.

Risk mitigation strategies are employed to reduce the impact of potential risks on the portfolio. These strategies may include investing in companies with strong management teams, investing in companies with a diversified customer base, or investing in companies that have a clear path to profitability.

Measuring Portfolio Performance

Measuring portfolio performance is an essential element of portfolio management in venture capital. Key performance indicators (KPIs) are used to evaluate the performance of the portfolio. The KPIs may include financial metrics, such as return on investment (ROI), internal rate of return (IRR), and multiple on invested capital (MOIC).

Benchmarking is an essential component of measuring portfolio performance. Benchmarking involves comparing the performance of a venture capital portfolio against relevant industry benchmarks, such as the S&P 500 or the NASDAQ. By benchmarking against relevant indices, venture capital firms can determine whether their portfolio is outperforming or underperforming the market.

Analysis of investment return metrics, such as IRR and MOIC, can help venture capital firms to assess the performance of their investments. The IRR is a measure of the rate of return that an investment generates over time, while the MOIC is a ratio of the total amount of money returned to investors relative to the amount of money invested.

Navigating the Exit Process

The exit process is a crucial element of portfolio management in venture capital. The exit process involves the sale of an investment in a portfolio company, which can provide a return on investment to the venture capital firm and its investors.

Exit strategy planning and execution are essential components of navigating the exit process. Venture capital firms must develop and execute a clear exit strategy for each portfolio company. The most common exit strategies include initial public offerings (IPOs), mergers and acquisitions (M&A), and secondary market sales.

Secondary markets can also play a role in the exit process. These markets provide an opportunity for venture capital firms to sell their investments in private companies to other investors. Secondary markets can help venture capital firms to realize a return on their investment without the need for an IPO or an M&A.

Driving Value Creation in Portfolio Companies

Driving value creation in portfolio companies is a crucial element of successful portfolio management in venture capital. Venture capital firms must identify and capitalize on value creation opportunities in their portfolio companies.

Strategies for value creation in portfolio companies may include introducing new products or services, expanding the customer base, or improving operational efficiency. Venture capital firms can also help portfolio companies to access new markets, provide guidance on strategy and execution, and provide access to a network of industry experts.

Collaboration and communication with portfolio companies are essential components of driving value creation. Venture capital firms must work closely with portfolio companies to identify value creation opportunities and provide the necessary resources and support to implement these strategies successfully. Regular communication with portfolio company management is also essential to track progress and make necessary adjustments as required.

Conclusion

Portfolio management is a critical component of success in venture capital. By following best practices for risk management, measuring portfolio performance, navigating the exit process, and driving value creation in portfolio companies, venture capital firms can achieve attractive returns while managing risk effectively.

The future of portfolio management in venture capital will continue to evolve as the industry adapts to new challenges and opportunities. The emergence of new technologies and industries, as well as changing economic conditions, will require venture capital firms to be agile and adaptable in their portfolio management strategies.

Despite the challenges, the importance of portfolio management in the venture capital industry cannot be overstated. With a focus on risk management, performance measurement, value creation, and effective communication, venture capital firms can continue to deliver attractive returns for their investors while playing a crucial role in driving innovation and economic growth.

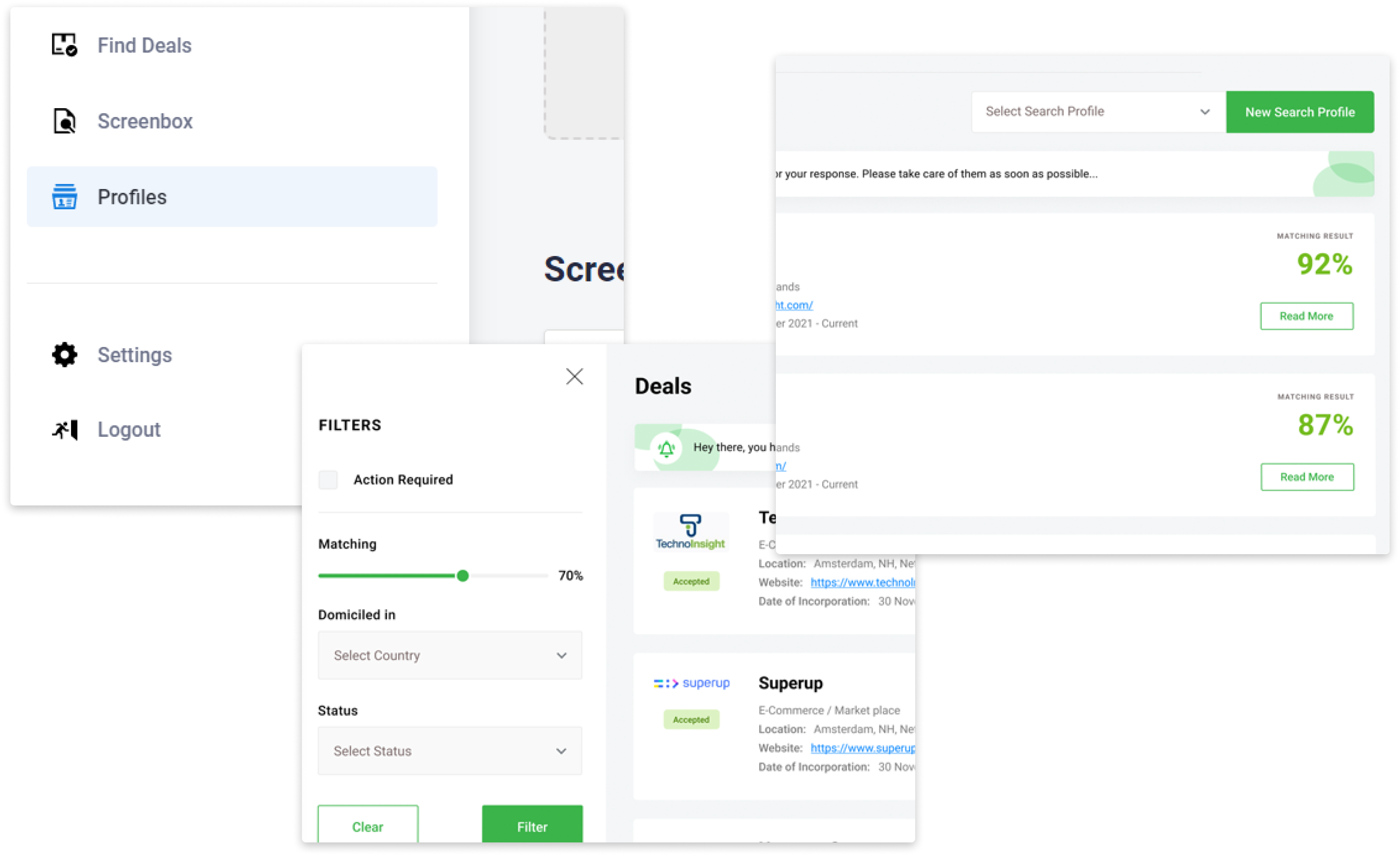

The Ultimate Overview of the VC Tech Stack

The Ultimate Overview of the VC Tech Stack

Download Our Ultimate Overview Of The VC Tech Stack For Free!