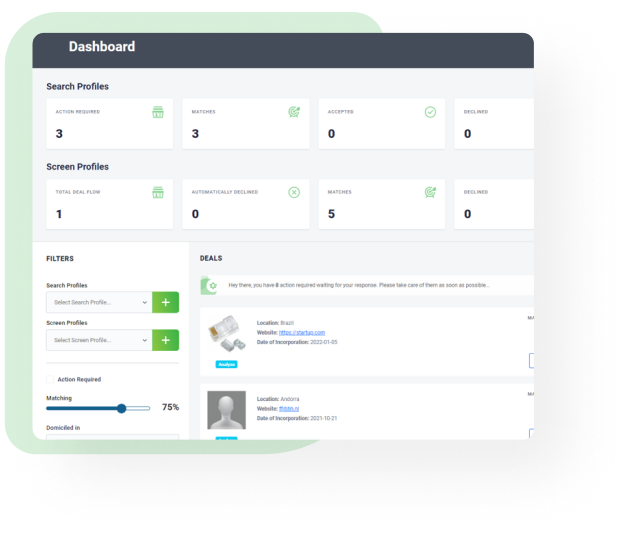

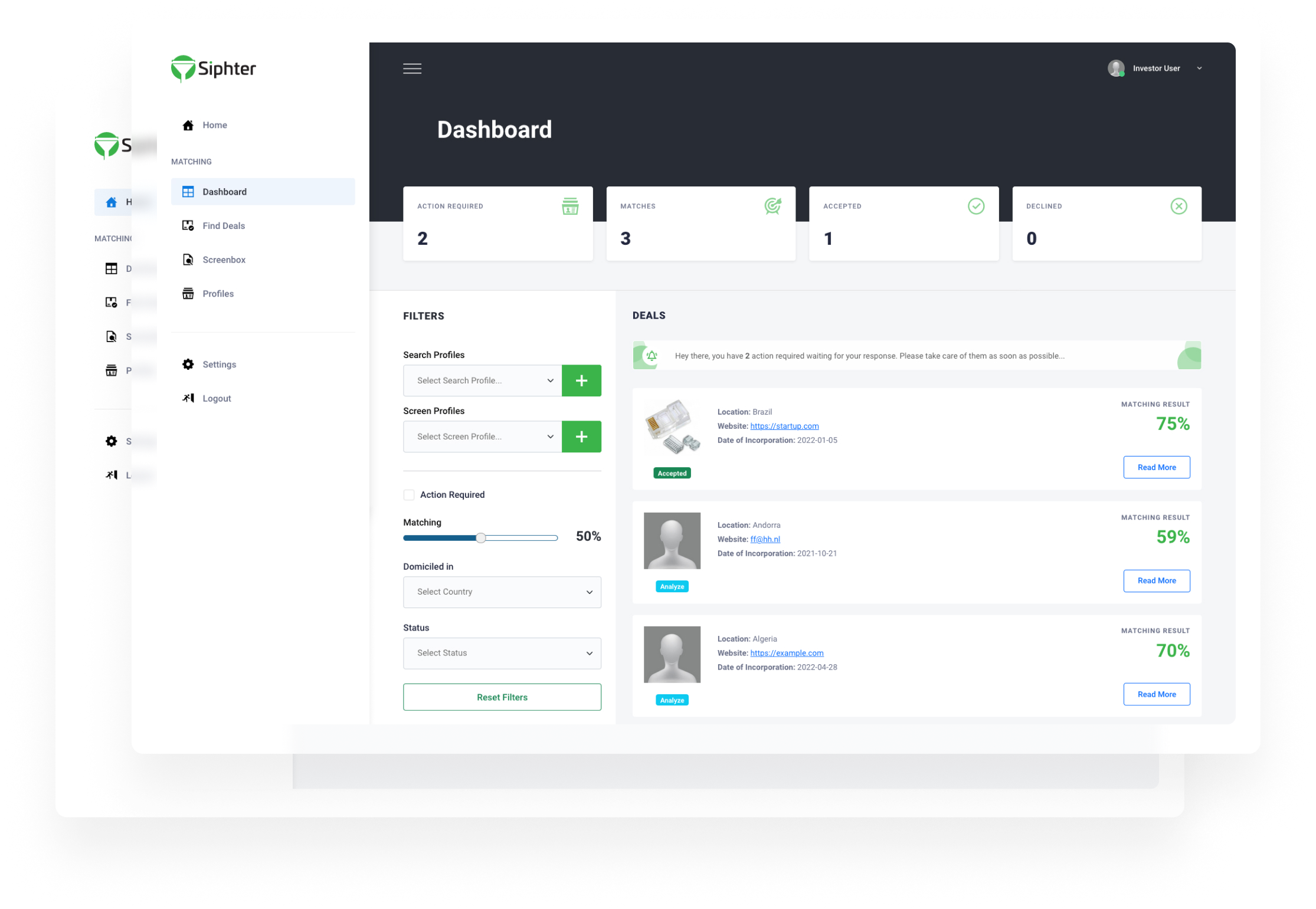

Based on which criteria does the ScreenBox screen the incoming deal flow?

All incoming deal flow is screened on 22 criteria. In addition, the investor can set the treshold (him/) herself. This is standard at 75% and can be increased or decreased as desired.

What value does Siphter bring investors?

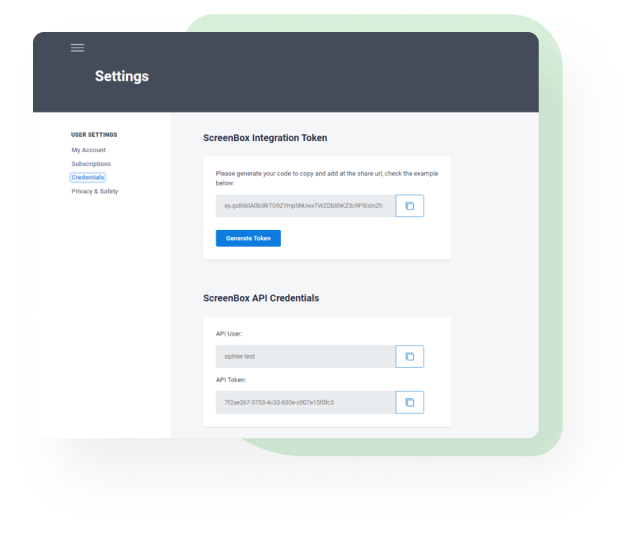

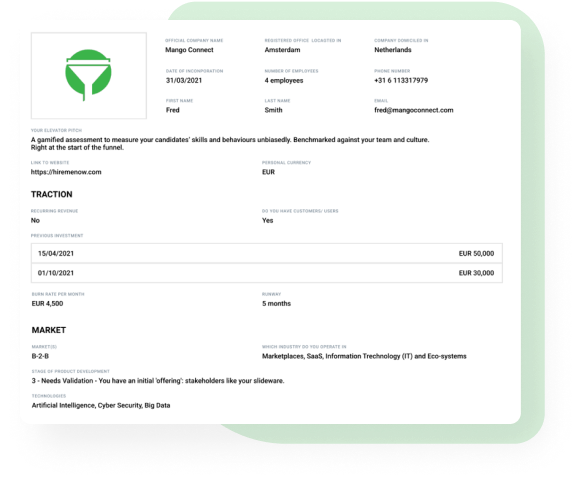

Siphter offers a smart and detailed matching engine using algorithms. Based on your profile

the matching engine will match you with start-ups looking for an investor. Siphter has a

database filled with start-ups from around the world. Once the match is made it’s up to you

to talk to the start-up founders and close the deal.

What's the minimum investment I can search for?

There's no minimum or maximum investment amount applicable. The reason for that is that

a US based start-up generally looks for higher amounts than for example a start-up in

LATAM or Africa. Keep in mind most investors are not interested in very small investment

opportunities. For small investments they go to a crowdfunding platform.

Can Siphter help me diversify my investment portfolio?

Absolutely! As we support diversity, we created a separate section on the intake form for

matching with start-ups from founders that are from underrepresented backgrounds. For

example; female founders, BAME founders, gender balanced teams, LGBTQ, etc. Anti-

selection is not possible.

Is there a minimum investment amount?

There's no minimum or maximum investment amount applicable. The reason for that is US

based start-ups generally look for higher amounts than for example a start-up in LATAM or

Africa. For small investments you better check a crowdfunding platform. It is your

responsibility to assure your investment is compliant with your local jurisdiction.

Do I need to be a qualified, professional or accredited investor to use

Siphter?

That depends on your local jurisdiction. Siphter can’t provide guidance on all country-specific

regulations. It is your responsibility, as highlighted in our Terms & Conditions, to check the

laws and regulations applicable in your country to investing and what is the exact meaning of

“qualified, professional or accredited investor” in order to assure your investment is

compliant with your local jurisdiction.