Fundraise Faster, Smarter and

More efficiently.

Are you pitching endlessly, chasing investors, and getting lost in the crowd? ——Siphter structures your fundraising journey and matches you with investors to secure the capital you need to grow your dream.

Efficiency on Autopilot

- Forget endless cold calls and dead-end meetings. Siphter's intelligent matching connects you with investors actively seeking startups in your sector.

Investor-Ready in Minutes

- Investment Readiness Test: Take our quick and insightful test to identify your strengths and weaknesses and get a roadmap to investor readiness.

- Powerful Startup CV: Craft a compelling and investor-focused CV that showcases your unique value proposition in a clear, concise format. Attract the right investors with ease.

Data-Driven Decisions

- Real-Time Insights give you valuable data-driven insights into your startup's attractiveness to investors and industry trends. Optimize your pitch and make informed decisions to maximize your fundraising success.

The Startup Funding Guide

Download our Startup Funding Guide For Free!

Frequently Asked Questions!

I'm a person with an underrepresented background. Can Siphter help me find investors?

Yes! Siphter supports diversity and we created a separate section on the intake form for matching with investors who are specifically investing in companies with founders and teams with an underrepresented background. For example; female founders, BAME founders, gender balanced teams, LGBTQIA+, etc. Discrimination is not possible and goes against our code of conduct.

I'm new to fund raising. Can Siphter help me find investors?

100%. Not only do we offer tools to help you better grasp where you stand in your valuation, but our intelligent infrastructure was designed to make highly relevant matches based on facts. This means you only have to submit your information to be connected to fitting investors.

What value does Siphter bring to startups?

Start-up founders gain access to an intelligent infrastructure to massively increase efficiency and opportunity in their fundraising journey by preparing them, structuring their start-up profile and automatically matching them with investors globally. Start-up founders will get access to a massive number of investors globally.

Does Siphter help startups find investors?

Yes! Siphter offers a smart and detailed matching engine using algorithms. Based on your profile the matching engine will match you with potential investors looking for a great company to invest in. From Angel investors to VC's. Once the match is made it's up to you to convince the investor to invest in your company.

What’s the minimum investment I can ask?

There's no minimum or maximum investment amount applicable. The reason for that is that a US based start-up generally looks for higher amounts than for example a start-up in LATAM or Africa. Keep in mind most investors are not interested in very small investment opportunities. For small investments we recommend you take a chance on a crowdfunding platform.

Is Sipther a crowdfunding platform?

No. We are not a crowdfunding platform. We focus on introducing start-up founders and potential investors for a direct investment in equity. We don't use a fund you invest in. Asked by Startups > Are my company details publicly shared on your platform and website? No. Different from other solutions on the market we do not publicly share your company or personal information. Your information is only available to an investor that is a match with your company profile. We value the privacy of our users and have therefore built a walled garden in terms of data.

Based on which criteria does the ScreenBox screen the incoming deal flow?

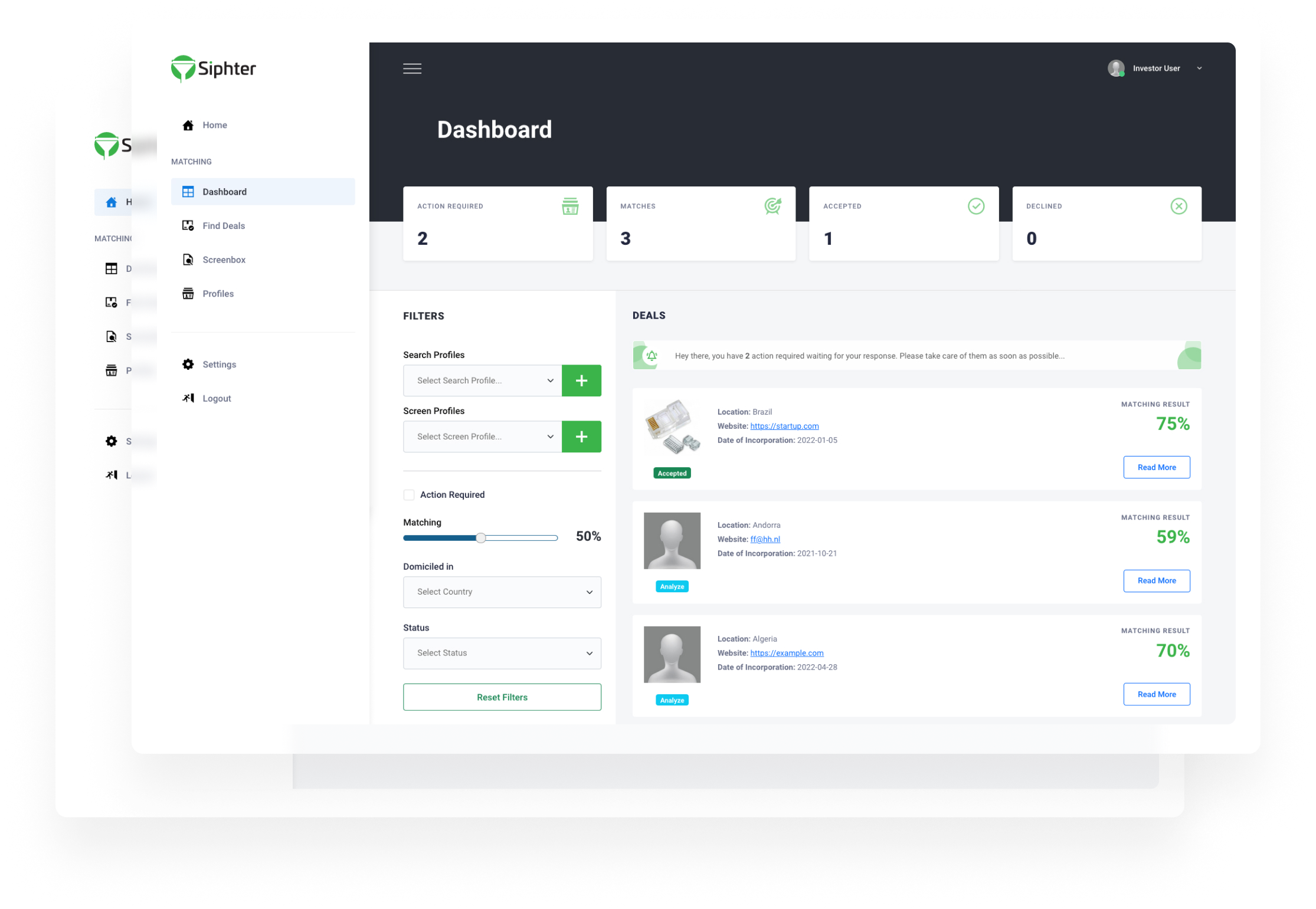

All incoming deal flow is screened on 22 criteria. In addition, the investor can set the treshold (him/) herself. This is standard at 75% and can be increased or decreased as desired.

What value does Siphter bring investors?

Siphter offers a smart and detailed matching engine using algorithms. Based on your profile the matching engine will match you with start-ups looking for an investor. Siphter has a database filled with start-ups from around the world. Once the match is made it’s up to you to talk to the start-up founders and close the deal.

What's the minimum investment I can search for?

There's no minimum or maximum investment amount applicable. The reason for that is that a US based start-up generally looks for higher amounts than for example a start-up in LATAM or Africa. Keep in mind most investors are not interested in very small investment opportunities. For small investments they go to a crowdfunding platform.

Can Siphter help me diversify my investment portfolio?

Absolutely! As we support diversity, we created a separate section on the intake form for matching with start-ups from founders that are from underrepresented backgrounds. For example; female founders, BAME founders, gender balanced teams, LGBTQ, etc. Anti- selection is not possible.

Is there a minimum investment amount?

There's no minimum or maximum investment amount applicable. The reason for that is US based start-ups generally look for higher amounts than for example a start-up in LATAM or Africa. For small investments you better check a crowdfunding platform. It is your responsibility to assure your investment is compliant with your local jurisdiction.

Do I need to be a qualified, professional or accredited investor to use Siphter?

That depends on your local jurisdiction. Siphter can’t provide guidance on all country-specific regulations. It is your responsibility, as highlighted in our Terms & Conditions, to check the laws and regulations applicable in your country to investing and what is the exact meaning of “qualified, professional or accredited investor” in order to assure your investment is compliant with your local jurisdiction.

What is Siphter?

We help start-up founders to massively increase efficiency and opportunity in their fundraising journey by preparing them, structuring their start-up profile and automatically matching them with investors globally. Start-up founders will get access to a substantial network of angel investors and venture capital firms.

Are you a crowdfunding platform?

No. We are not a crowdfunding platform. We focus on introducing start-up founders and potential investors for a direct investment in equity. Thankfully for us, we don’t have to manage any kind of fund.

How do you make money?

Siphter is subscription based. That means you pay a fee per month or per year. We also offer in-platform tools you can buy per use.

Is Siphter in any way funnelling investments through the platform?

No. Besides subscription fees there are currently no other revenue streams running through Siphter. Siphter only makes introductions, after the introduction it's between the startup and the investor to work towards a deal. Off platform, without Siphter.

Join the league of investors and startups using Siphter Matching and Screenbox. Choose efficiency.

Start Free Trial Now